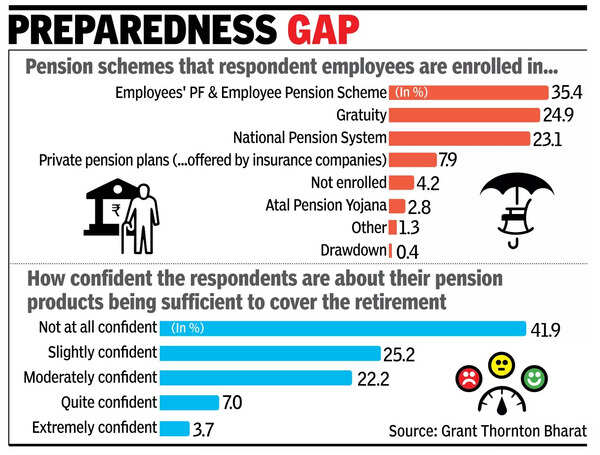

NEW DELHI: Higher earners contribute more to retirement products, but the overall contribution is still relatively low for most individuals, suggesting that many people may not be saving enough for retirement, a survey showed on Wednesday.Nearly 83% of participants relied largely on three retirement products: EPF, gratuity, and NPS. “This reliance on traditional schemes suggests limited diversification in retirement portfolios,” said the survey conducted by consulting firm Grant Thornton Bharat.

The results showed that more than half (55%) of respondents expect a monthly pension exceeding Rs 1 lakh. However, only 11% believe their current investments are sufficient to meet these expectations. “This stark disparity highlights a significant preparedness gap that needs to be addressed through better financial planning and awareness,” said the report, the survey for which was conducted by the consulting firm in Aug and Sept last year.Govt-backed plans remain the most preferred option, with 39% of participants favouring such schemes. About 27% of respondents showed a preference for private plans offered by reputable financial institutions. High-risk, high-return plans were particularly popular among younger respondents, with 31% of participants under 25 years interested in these options. “This finding suggests a growing appetite for risk among the younger demographic,” said the report.With regard to the age of retirement, about 56% of respondents said they plan to retire between the age of 55 and 65. “This age range aligns with standard retirement practices in India and reflects the broader societal norms regarding work and retirement in the country,” according to the report. Younger respondents, particularly those who were 25 years or below, preferred early retirement. Among this group, 43% showed a preference to retire between 45-55 years. “Trend indicates shift in attitudes among younger employees, who may prioritise work-life balance & leisure over extended career spans,” said the report.The majority, 74% of respondents, said that they contribute between 1% and 15% of their salary toward retirement plans. “This contribution range indicates a cautious approach to savings, possibly influenced by financial constraints or competing priorities,” said the report. Asked to respond about their knowledge of pension calculations, 52% of respondents said they were somewhat aware of how their pensions are determined, while 30% admitted to being completely unaware.