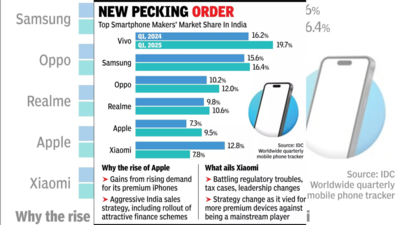

NEW DELHI: In a major upset in the Indian smartphone market, Apple overtook Chinese giant Xiaomi in sales during the first quarter of this year, cracking the Top 5 ranking in terms of market share.While Apple has gained from rising demand for its premium iPhones, the fall for Xiaomi – which is now ranked sixth according to the latest IDC numbers – has been unprecedented considering that the company dominated the Indian market for several years, lording over top global, while also decimating homegrown players such as Micromax, Lava, and Karbonn.The category is now led by fellow Chinese Vivo, which is sitting on top of the pile, followed by Samsung, Oppo, realme, and Apple (see graphic). While Samsung stayed flat, Vivo and Oppo also gained market share, with almost all players expanding at Xiaomi’s expense.Apple’s juggernaut seems to be going strong due to the aggressive nature of its India sales strategy, including rollout of attractive finance schemes.Research firm IDC said Apple is the brand to watch out for as the average selling price (ASP) of iPhones in India is roughly three times the broader market, which simply means people are ready to pay significantly more for an Apple device. “Anybody and everybody wants an iPhone. People see iPhones in the hands of their friends and family and want one for themselves. You can even call it peer pressure or simply the pull of the brand,” Navkendar Singh, analyst with IDC Asia Pacific, told TOI.Sources said Xiaomi has been going through a challenging period over the past few years, battling a slew of regulatory troubles and tax cases apart from leadership changes. “The company has seen numerous tax-related disputes, and these include investigations by the Enforcement Directorate and income tax department. This has had a massive impact on the morale of senior management,” a source said. The company saw the exit of CEO Manu Jain, who first went to Dubai and then parted ways at the height of tax probe in early 2023.There have been other top management exits.Many also blame the decline in Xiaomi’s numbers to the change of strategy as it vied for more premium devices against being a mainstream player. “This strategy has failed and the company’s products are priced out in several categories. The company has also lost its grip in its core online sales, apart from being weak in offline too,” the source said.