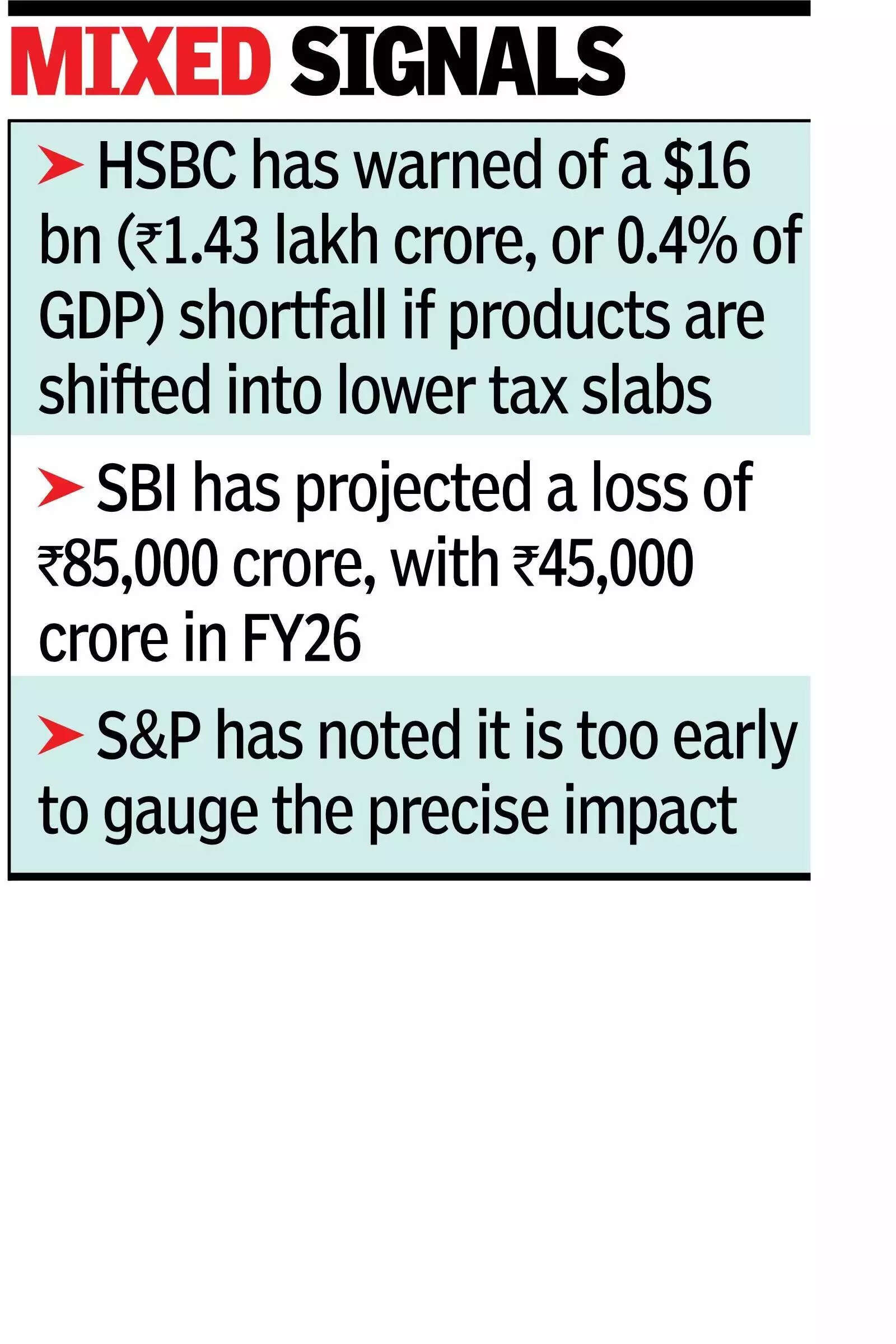

MUMBAI: The government’s planned GST overhaul has drawn mixed assessments from HSBC, S&P and SBI, with estimates of a potential revenue gap ranging from Rs 60,000 crore to Rs 1.43 lakh crore, though the actual fiscal impact remains uncertain. HSBC warned of a $16 bn (Rs 1.43 lakh crore, or 0.4% of GDP) shortfall if products are shifted into lower tax slabs, while SBI projected a smaller average loss of Rs 85,000 crore, with Rs 45,000 crore in FY26, that could be largely offset through the compensation cess. S&P, meanwhile, noted it was too early to gauge the precise impact, adding that reforms were unlikely to be pushed to the extent of significantly weakening government revenues.

Mixed signals

HSBC’s analysis suggested the revenue burden would be equally split between the Centre and states, but pointed out that states may find it harder to manage under FRBM deficit caps without cutting capital expenditure. If the Centre were to compensate them, it would need fresh resources, though raising taxes on luxury goods would dilute the intent of simplifying slabs. Still, HSBC highlighted two benefits from the move – a near-term demand boost and long-term efficiency gains from a simpler, more predictable system.SBI’s assessment was more sanguine, arguing that the immediate revenue loss can be absorbed using the cess buffer. Even if it isn’t, it estimated that a consumption boost of Rs 5.5 lakh crore could generate around Rs 52,000 crore in additional GST collections. The proposed reform would collapse the four current GST slabs – 5%, 12%, 18% and 28% – into two (5% and 18%), with a 40% rate for luxury and sin goods.