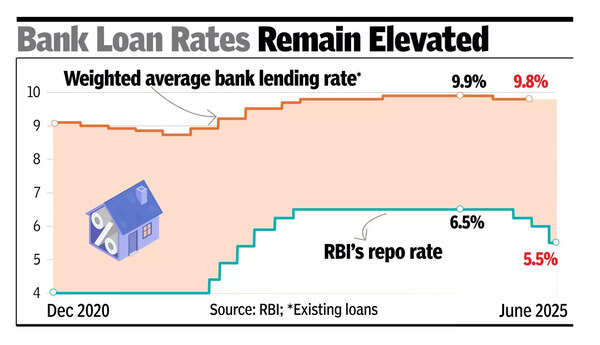

MUMBAI: An RBI report has called on lenders to reduce loan rates, saying financial conditions are conducive for transmitting the central bank’s 50-basis-point (100bps = 1 percentage point) policy rate cut from June 6 to the credit market. In its state of the economy report for June, RBI noted that high-frequency indicators for May 2025 signal resilient economic activity across the industrial and services sectors. Agriculture also showed broad-based growth across major crops in 2024-25, while inflation remained below its target for the fourth consecutive month.

While the domestic outlook remains optimistic, the global economic backdrop appears fragile. “The global economy is in a state of flux, reeling from the twin shocks of trade policy uncertainties and a spike in geopolitical tensions,” the report said, citing market volatility following the Iran-Israel conflict. Reports from multilateral agencies such as the OECD and World Bank have flagged potential deterioration in medium-term global prospects amid rising protectionism.On the domestic front, the equity markets saw modest gains during May and June but experienced a sharp, short-lived dip before rebounding strongly on June 20, amid heightened tensions in West Asia. The report flagged concerns over near-term inflation pressures and rising term premia due to the worsening US fiscal situation, as well as widening emerging market spreads amid risk-off sentiment.Looking ahead, the central bank said, “Forward-looking surveys of consumer sentiments show stable consumer confidence for the current period and improved optimism about the future.” It also noted that state govts appear fiscally calibrated, planning to raise capital outlay to 3% of GDP in FY26, underlining a focus on quality expenditure. The IMD’s forecast of above-normal southwest monsoon rainfall at 106% of the long-period average is expected to support rural consumption and agricultural output.The report said that India has posted the highest growth among major economies, with a sharp pickup in Q4 FY25 driven by strong fixed investment, high manufacturing capacity utilisation, and buoyant services growth supported by record hiring. However, concerns remain around slowing credit growth, tepid urban demand, rising unemployment, and weaker state finances.