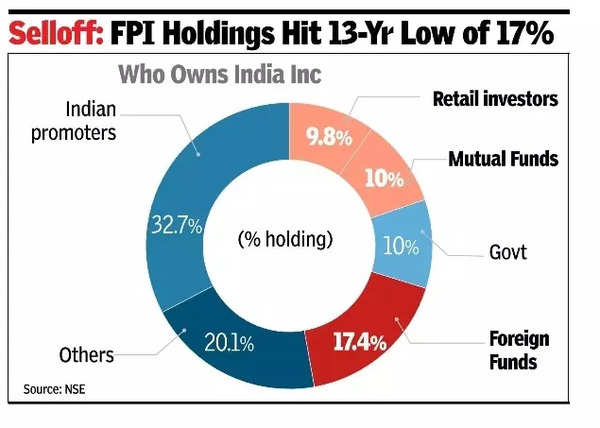

MUMBAI: For the first time since 2006, The combined shareholding of mutual funds and retail investors is more than that of foreign portfolio investors, an analysis by NSE showed. This comes on the back of persistent selling by foreign funds since Oct last year while domestic institutions, dominated by mutual funds, remained net buyers.

The analysis, using shareholding data disclosed by companies as of December 2024, also showed that foreign ownership of stocks listed on the NSE, at 17.4%, was the lowest in 13 years.

Aided by sustained SIP inflows, MFs’ share rose further to a all-time high of 10% in NSE listed companies, the analysis noted. “MFs injected a record net amount of Rs 1.5 lakh crore in the December quarter, and further (about) Rs 71,000 crore in the first one-and-a half month of this quarter, taking the total net inflows to Rs 4.2 lakh crore in the fiscal thus far (as of Feb 14, 2025).”

The analysis also showed that individual investors’ direct non-promoter ownership in India Inc was at nearly 18-year high of 9.8%, corroborating with record investments of about Rs 56,000 crore in the Dec quarter. “Individuals as direct and indirect (via MFs) investors (now) own a record-high of 18.2% of the total market cap, outpacing the share of FPIs (17.4% now) for the first time since 2006,” researchers at NSE noted.

In March 2014, the gap in ownership between FPIs and individual investors along with MFs was as high as 11 percentage points. This reversing of the gap indicates the growing role and significance of individual investors in the Indian equity markets. “Strong performance of Indian equities, coupled with rising participation, has resulted in a significant increase in household wealth over the last few years. Our estimates suggest that the household wealth in Indian equities increased by over Rs 46 lakh crore in the last five years, and Rs 30 lakh crore in the last two years.”

The analysis by researchers at NSE also showed a steady decline in promoter holding in Indian companies. “Total promoters’ share in the NSE-listed companies fell for the second quarter in a row 49.6%. The decline was broad-based across categories, with the most significant dip seen in the govt holding. In Nifty, the drop was more pronounced bringing promoter ownership to a two-decadal low of 41.4%.”