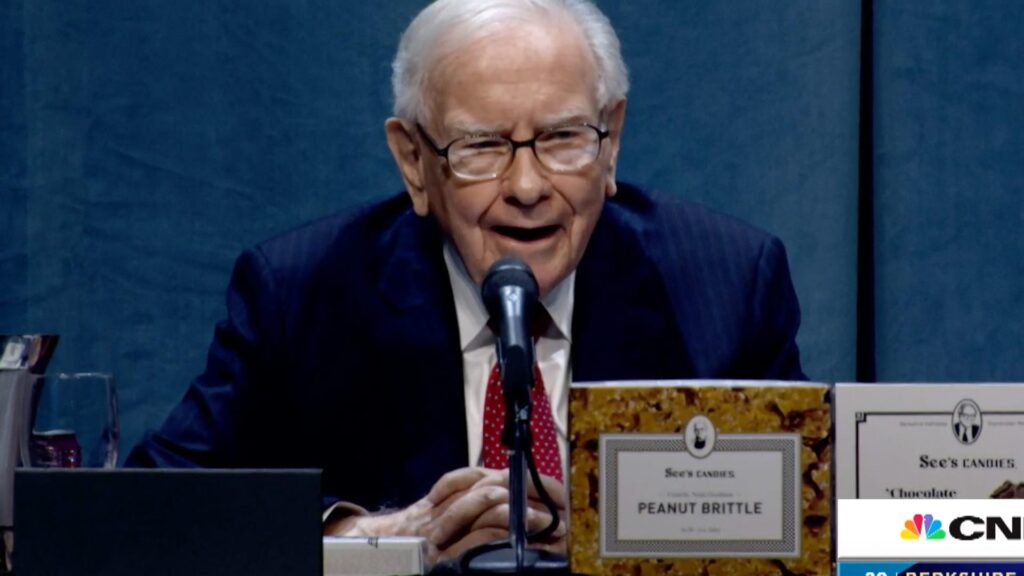

Warren Buffett at a press conference during the Berkshire Hathaway Shareholders Meeting on April 30, 2022.

CNBC

Legendary investor Warren Buffett made a rare comment on President Donald Trump’s tariffs, saying punitive duties could trigger inflation and hurt consumers.

“Tariffs are actually, we’ve had a lot of experience with them. They’re an act of war, to some degree,” said Buffett, whose conglomerate Berkshire Hathaway has large businesses in insurance, railroad, manufacturing, energy and retail. He made the remarks in an interview with CBS News’ Norah O’Donnell for a new documentary on the late publisher of the Washington Post, Katharine Graham.

“Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” Buffett said with a laughter. “And then what? You always have to ask that question in economics. You always say, ‘And then what?'”

This marks the first public remark from the 94-year-old “Oracle of Omaha” on Trump’s trade policies. Last week, Trump announced that the sweeping 25% tariffs on imports from Mexico and Canada will go into effect March 4 and that China will be charged an additional 10% tariff on the same date. China has vowed to retaliate.

During Trump’s first term, the Berkshire chair and CEO opined at length in 2018 and 2019 about the trade conflicts that erupted, warning that the Republican’s aggressive moves could cause negative consequences globally.

When asked about the current state of the economy by CBS, Buffett refrained from commenting on it directly.

“Well, I think that’s the most interesting subject in the world, but I won’t talk, I can’t talk about it, though. I really can’t,” Buffett said.

Buffett has been in a defensive mode over the past year as he rapidly dumped stocks and raised a record amount of cash. Some read Buffett’s conservative moves as a bearish call on the market and the economy, while others believe he’s preparing the conglomerate for his successor by paring outsized positions and building up cash.

Market volatility has ramped up as of late as concerns grew about a slowing economy, unpredictable policy changes from Trump as well as overall stock valuations. The S&P 500 is up just about 1% this year.