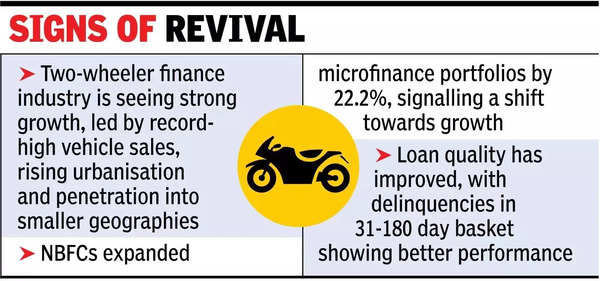

MUMBAI: Microfinance and two-wheeler finance, key credit segments for new-to-credit borrowers, are showing signs of recovery after facing challenges. The microfinance sector is stabilising with improved loan quality and portfolio shifts, while NBFCs are playing a growing role in the segment. Meanwhile, the two-wheeler finance industry is seeing strong growth, driven by record-high vehicle sales, rising urbanisation, and increasing penetration into smaller geographies.

According to MFIN, an association representing lenders in the micro segment, NBFC-MFI portfolios declined by 3.8% from Dec 2023 to Dec 2024, while bank portfolios shrank by 5.5%, and small finance banks saw an 11% drop.

However, NBFCs expanded their microfinance portfolios by 22.2%, indicating a shift towards growth. Loan quality has improved, with delinquencies in 31-180 day basket showing better performance. The sector now serves 7.9 crore unique borrowers through 13.9 crore loan accounts. The East and North East continue to dominate the market, followed closely by the South.

Microfinance firms are strengthening internal controls, improving risk management and enhancing customer protection mechanisms, in the wake of RBIs measures to curb build up of risks. A decline in the number of clients holding multiple loans suggests a focus on reducing over-indebtedness. Banks remain the largest funding source, contributing 61.3% of outstanding borrowings as of Dec 2024.

According to CRIF High Mark, the two-wheeler finance sector rebounded after a slowdown in FY24, with loan originations recovering in H1FY25. The top 10 lenders hold 75% of the market, but lenders ranked 11-20 and 21-30 are steadily gaining traction. There is a shift towards higher loan ticket sizes above Rs. 75,000 and deeper geographical penetration beyond the top 100 districts. However, asset quality deterioration is a concern, delinquencies in the 31-180 day basket in Sep 2024 reaching the highest level in six quarters, driven by the top 11-20 lenders. The top 21-30 lenders performed better, but early-stage delinquencies remain high.