MUMBAI: In a major rollback of its curbs on lending to non-bank finance companies, RBI on Tuesday lowered risk weights for bank credit to NBFCs and microfinance loans.

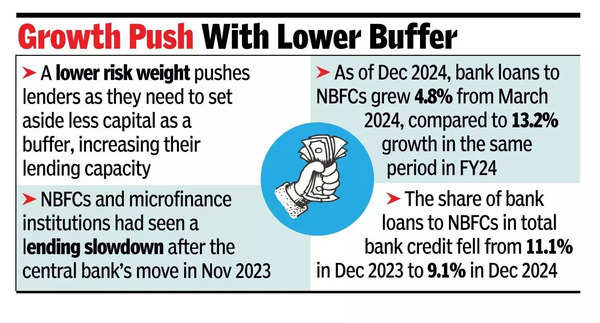

A lower risk weight encourages lenders as they now need to set aside less capital as a buffer, increasing their lending capacity. In Nov 2023, RBI had raised risk weights for consumer credit exposures, including personal loans, by 25 percentage points to 125%. For NBFCs, the risk weights were also increased by 25 percentage points for exposures where the existing risk weight was below 100%.

The increase aimed to preempt potential risks in this segment, as it was growing faster than overall credit growth. The rollback comes as bank lending to NBFCs has slowed significantly. As of Dec 2024, bank loans to NBFCs grew 4.8% from March 2024, compared to 13.2% growth in the same period in FY24. NBFCs and microfinance institutions had seen a lending slowdown after the central bank’s move in Nov 2023.

The share of bank loans to NBFCs in total bank credit fell from 11.1% in Dec 2023 to 9.1% in Dec 2024. “On a review, it has been decided to restore the risk weights applicable to such exposures,” RBI said in a circular. It also clarified that microfinance loans classified as consumer credit will be subject to a 100% risk weight, instead of the higher rate set earlier.

Microfinance loans that do not fall under consumer credit but meet certain criteria may be included under the regulatory retail portfolio if banks have appropriate policies and procedures. Loans extended by regional rural banks and local area banks will attract a risk weight of 100%, RBI said.

According to MFIN data for Q3 FY24, the microfinance portfolio declined 3.5% year-on-year to Rs 3.9 lakh crore. “The restoration of lower risk weights for better-rated NBFCs will improve credit flow from banks to NBFCs and benefit their capital ratios. With improved credit flow to NBFCs, overall credit flow to the retail segment is expected to improve, supporting economic growth. This change, along with the deferment of proposed liquidity coverage ratio norms, is expected to improve bank credit in FY26 compared to FY25,” said Anil Gupta, senior VP & co-group head – financial sector ratings, ICRA.