Mumbai:

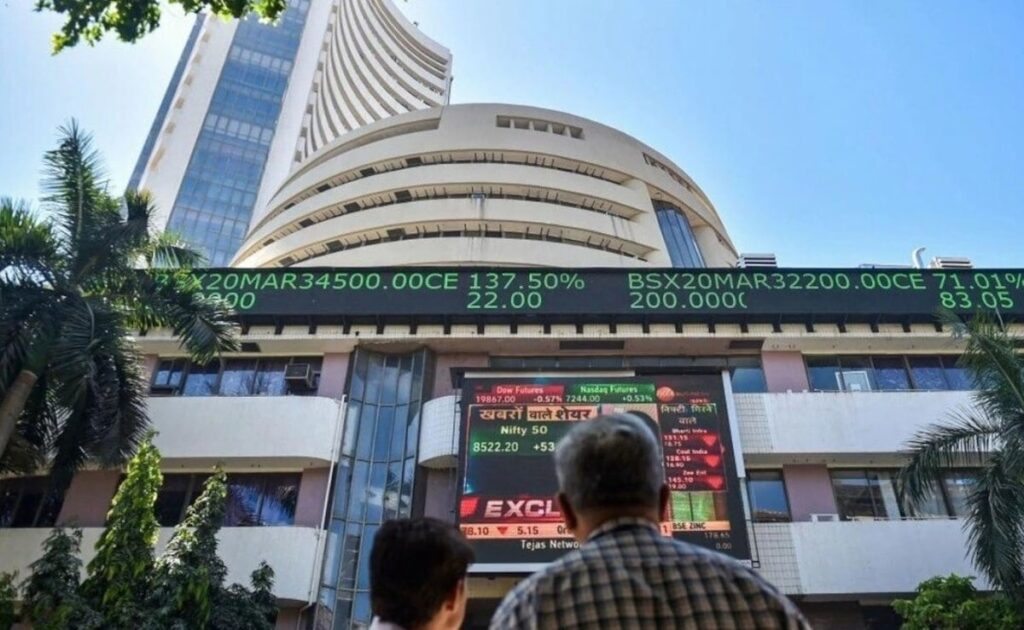

The Indian benchmark indices opened higher on Tuesday as buying was seen in the media and auto sectors in the early trade.

At around 9.36 am, Sensex was trading 192.68 points or 0.26 per cent up at 74,647.09 while the Nifty climbed 33.85 points or 0.15 per cent at 22,587.20.

Nifty Bank was up 33.70 points or 0.07 per cent at 48,685.65. Nifty Midcap 100 index was trading at 49,688.40 after declining 324.70 points or 0.65 per cent. Nifty Smallcap 100 index was at 15,382.20 after dropping 95.10 points or 0.61 per cent.

According to experts, Nifty has broken the low and decisively closed below it. Also, the Nifty closed below the support line. The bearish trend can pick up momentum on the downside since the support level is broken.

“The lower end of the downward sloping channel is at 22100. 22820 will be a crucial resistance level and trend reversal as well,” said Vikram Kasat, Head Advisory of PL Capital.

Meanwhile, in the Sensex pack, M&M, Zomato, Maruti Suzuki, Nestle India, ICICI Bank, Hindustan Unilever, Bajaj Finserv, Bharti Airtel and Kotak Mahindra Bank were the top gainers. Whereas, L&T, Tech Mahindra, TCS, PowerGrid, Sun Pharma, NTPC, HCL Tech, UltraTech Cement and Titan were the top losers.

In the last trading session, Dow Jones climbed 0.08 per cent to close at 43,461.21. The S&P 500 declined 0.50 per cent to 5,983.25 and the Nasdaq declined 1.21 per cent to close at 19,286.93.

In the Asian markets, Seoul, China, Bangkok, Japan, Jakarta and Hong Kong were trading in red.

On the institutional front, foreign Institutional Investors (FIIs) continued their selling streak, offloading equities worth Rs 6,286.70 crore on February 24. Meanwhile, domestic Institutional Investors (DIIs) extended their buying spree, acquiring equities worth 5,185.65 crore on the same day.

“Given the prevailing market dynamics, traders are advised to exercise caution and wait for confirmation of price action at critical levels before initiating fresh positions,” said Hardik Matalia of Choice Broking.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)