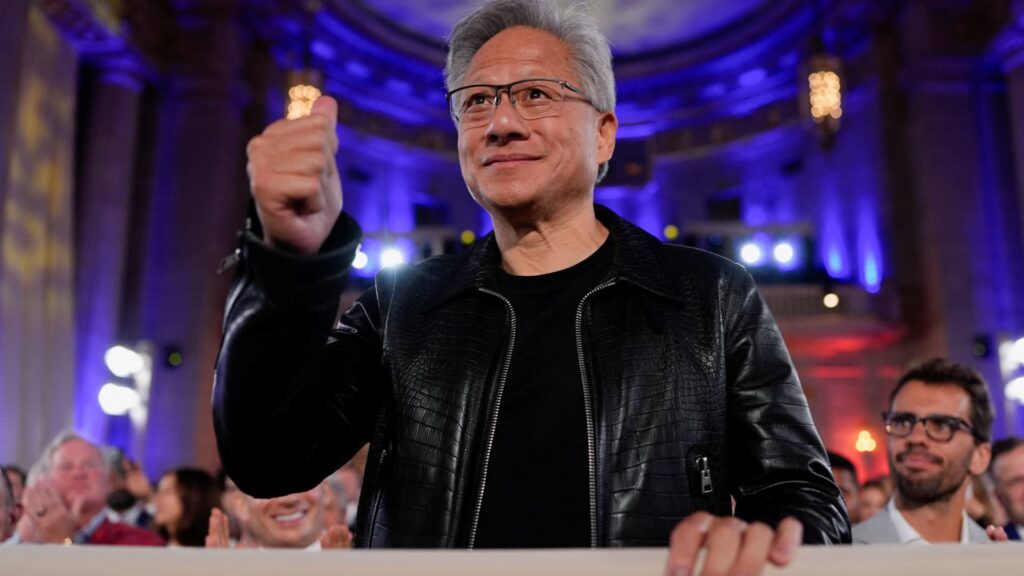

Nvidia CEO Jensen Huang attends the “Winning the AI Race” Summit in Washington D.C., U.S., July 23, 2025.

Kent Nishimura | Reuters

Nvidia reports fiscal second-quarter earnings on Wednesday after the bell.

Here’s how Nvidia is expected to do versus LSEG consensus estimates:

- Earnings per share: $1.01, adjusted

- Revenue: $46.02 billion

That would represent 53% year-over-year revenue growth for Nvidia, which carries a market cap of more than $4 trillion and is already the most valuable company in the world.

That type of growth would add to a streak of explosive growth for the chipmaker, which has been on a tear since the arrival of OpenAI’s ChatGPT in late 2022 ushered in the generative artificial intelligence era and created insatiable demand for graphics processing processing units, or GPUs.

Nvidia’s revenue growth has been driven by its data center business, which accounts for about 88% of the company’s total sales.

There are two key questions analysts will want Nvidia to answer about its data center business: How are the current generation of chips doing? And what’s the state of the company’s business in China?

Analysts will want any color that Nvidia CEO Jensen Huang can give them about how sales of the company’s Blackwell chips are going. Earlier this year, Nvidia said that Blackwell sales would be limited by the number of racks the company can make, not how many customers wanted to buy them.

Blackwell comes in several different configurations, including one called GB200 that are typically sold in a finished rack computer that has 72 GPUs and costs millions of dollars.

“That’s probably going to be the most important thing, because I think right now, demand is clearly outstripping supply,” KeyBanc analyst John Vinh told CNBC.

The other big question facing Nvidia is its China business. In 2023, it introduced a slowed-down chip, called the H20, specifically to comply with export controls to China. In April, the Trump administration said the H20 would require a license. A month later, Nvidia said it would lose out on $8 billion in sales to China.

The Trump administration in July said it would grant those licenses. But the Chinese government has signaled in August that China-based technology companies should use homegrown chips, raising questions about demand in that country.

Most analysts expect Nvidia to completely exclude China from its guidance. According to LSEG estimates, Nvidia is expected to guide to nearly $53 billion in sales for its fiscal third quarter, which would represent 51% annual growth.

WATCH: What’s next for Nvidia in China