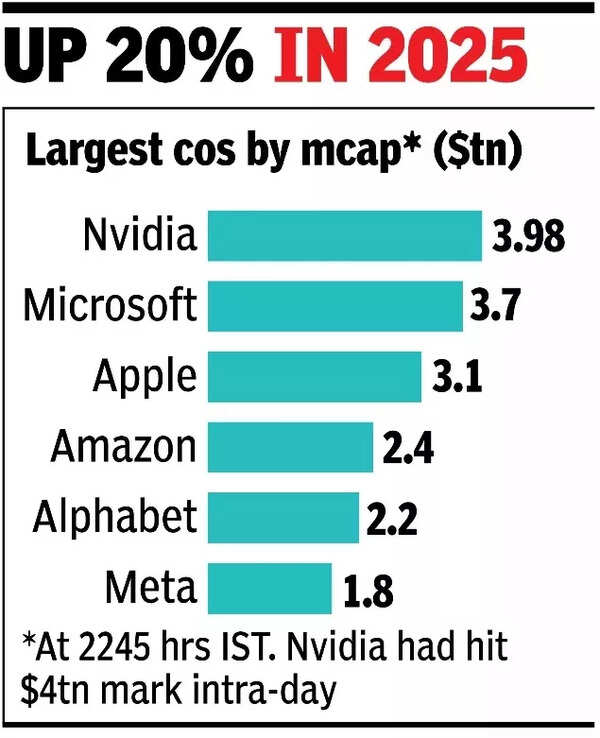

Nvidia became the first company in history to achieve a $4-trillion market valuation, cementing its status as a kingpin in the global financial market.Shares jumped 2.8% to $164 on Wednesday to crack the milestone, marking a stunning rebound following a rough start to the year, when spending fears sparked by China’s DeepSeek, along with US President Donald Trump’s trade war, weighed on risk sentiment.The stock has risen more than 20% in 2025, and is up more than 1,000% since the beginning of 2023. Nvidia now accounts for 7.5% of the S& index, near its highest influence on record.

The latest catalyst for the stock has been a commitment to AI spending from Nvidia’s biggest customers, showing that demand for its computing systems remains strong. This includes tech giants Microsoft, Meta, Amazon and Alphabet, who are projected to put about $350 billion into capital expenditures in their upcoming fiscal years, up from $310 billion in the current year, average of analyst estimates showed. Those companies account for more than 40% of Nvidia’s revenue.Investors have been piling back into the AI trade after a choppy first half of 2025. In Jan, the emergence of DeepSeek stoked concerns that the heavy spending on AI would soon dwindle, leading shares of Nvidia and other AI plays to plunge. Trump’s tariff threats in April added to concerns about the global macroeconomic backdrop and led to further selling. Investors, usually swift to buy any dip in Nvidia, rotated out of their highest-flying stocks in favour of defensive sectors.