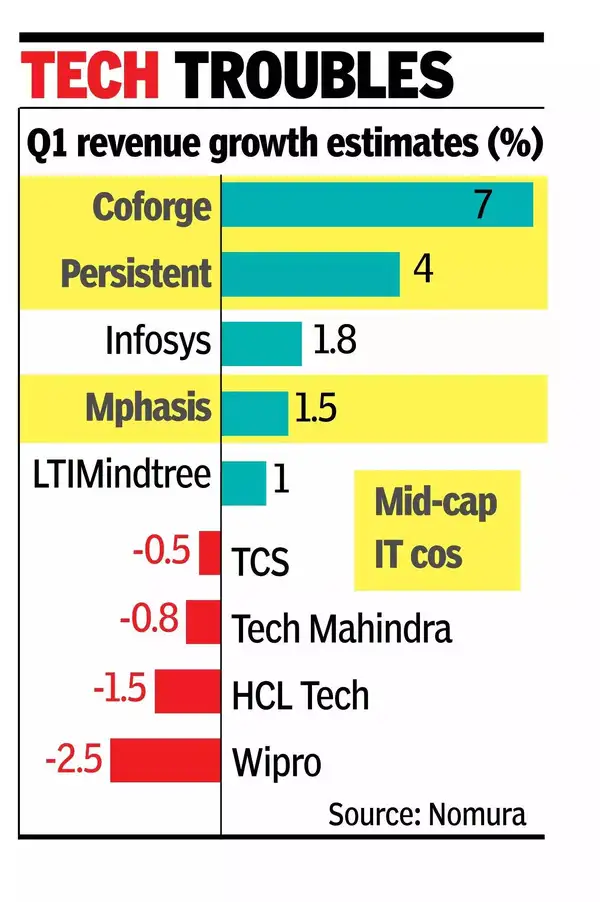

BENGALURU: Midcap IT firms are poised to outperform large caps in the June quarter, analysts said. Deal signings continued steadily, with minimal large client cutbacks despite ongoing macroeconomic uncertainty, geopolitical tensions, and tariff concerns. However, clients remain cautious with discretionary spending amid these challenges.Brokerage firm Nomura expects large caps to report a subdued quarter, with most companies – except Infosys and LTIMindtree – likely to see sequential revenue declines in constant currency terms. Their estimates include a 0.5% drop for TCS, 1.5% for HCLTech, 2.5% for Wipro, and 0.8% for Tech Mahindra, while Infosys and LTIMindtree are expected to post modest growth of 1.8% and 1%, respectively. In contrast, midcaps are likely to outperform, with quarterly constant-currency revenue growth of 7% for Coforge, 4% for Persistent, and 1.5% for Mphasis.

Analysts also highlight cross-currency tailwinds of 80-220 basis points driven by the sharp depreciation of the dollar against major global currencies like the British pound, euro, and Japanese yen, which should provide additional support to earnings.BNP Paribas projects large IT firms to face sequential revenue declines between 1% and 2.5%, attributed to project ramp-downs and seasonal factors. Infosys is expected to outperform peers, while midcaps are forecast to deliver sequential dollar organic revenue growth ranging from 1% to 4%. BNP Paribas anticipates Infosys will tighten guidance to 1.5-3.5% growth, with HCLTech maintaining its 2-5% constant currency revenue growth outlook for FY26. Motilal Oswal noted that despite a series of geopolitical events and tariff uncertainties that could dampen deal activity, widespread client deferrals were largely avoided.