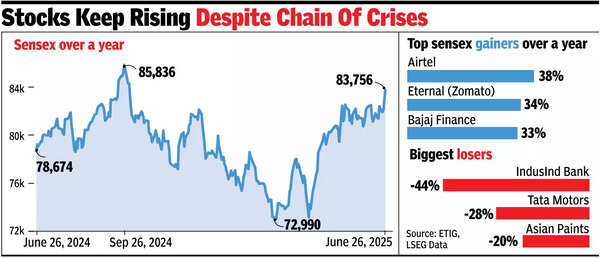

MUMBAI: The sensex is not far behind Wall Street indices that are racing to their record highs. On the back of resilient domestic economic fundamentals, the sensex on Thursday closed 1,000 points (1.2%) up at 83,756 points, less than 3% off its Sept-end peak of 85,978 points.On the NSE, Nifty too rallied 304 points (1.2%) to close at 25,549 points, just 2.8% or 728 points away from its record high as foreign investors returned.

Signs of stability in West Asia that witnessed escalating tension between Israel and Iran first and then the US joining forces with Israel in bombing nuclear facilities in Iran over the past two weeks, prompted investors to buy stocks. The weakness of the dollar and the fall in crude oil prices, India’s biggest import item, also helped the rally.On the domestic front, RBI’s move to sharply cut interest rate by half a percentage point earlier this month and stable inflation numbers helped investor sentiment, market players said.According to Ajit Mishra of Religare Broking, the domestic markets witnessed a decisive session on Thursday that was supported by stable global cues, followed by a range-bound move in the first half. However, the market momentum picked up as the session progressed, driven by strong buying in select heavyweights across sectors, Mishra said. The broking house now expects the leading indices to gradually move towards their record high levels.The day’s rally was led by foreign funds that net bought stocks worth Rs 12,594 crore, the biggest single-session net inflow figure since Sept 20, 2024. On the other hand, domestic funds were net sellers at Rs 195 crore, data on the BSE website showed. Thursday’s strong upsurge in the market added about Rs 3.5 lakh crore to investors’ wealth with BSE’s market capitalisation now at Rs 457.5 lakh crore, data showed.