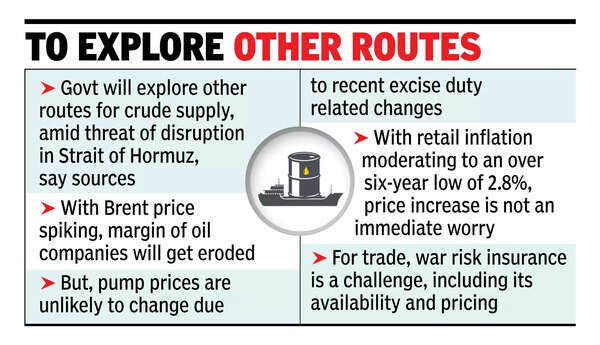

NEW DELHI: Govt is drawing comfort from its diversified oil purchases but is keeping close tabs on the situation in the Strait of Hormuz, which accounts for nearly a fifth of global oil consumption, in the wake of the US attack on Iran.The Strait – which serves as the primary export route for Persian Gulf producers such as Saudi Arabia, the UAE and Iraq – is crucial not just for crude supply – but also cargo headed to West Asian markets. Amid the threat of disruption by Iran, govt sources indicated that other routes will be explored.With Brent spiking to $90 a barrel, the margin of the oil companies selling petrol and diesel will get eroded but is unlikely to result in changes in pump prices due to the recent excise duty related changes. Although Opec may impact the overall calculations, India is estimated to have imported more oil from Russia this month than the combined quantity of shipments from West Asia. India’s strengthening of ties with Russia on crude purchases post-Ukraine conflict are expected to come to its aid to ensure that there is no disruption, sources said.

Beyond oil, there may be concerns on gas as large quantities come from the Gulf region. Besides, the price of piped cooking gas and CNG are linked to these and may impact the overall cost dynamics for industry too.Given that retail inflation in May had moderated to an over six-year low of 2.8%, price increase is not an immediate worry, but its future trajectory will weigh on policymakers, apart from adding to the already high levels of geo-political uncertainty.For trade, war risk insurance is seen to be a challenge, including its availability and pricing. “Overall demand will take a hit. There is massive uncertainty,” said Fieo director general Ajay Sahai.“Simultaneously, the situation in nearby Red Sea is deteriorating. Following Israeli airstrikes on Houthi forces on June 14-15, tensions have escalated, placing India’s westbound exports at fresh risk. Nearly 30% of India’s exports to Europe, North Africa, and US East Coast transit through the Bab el-Mandeb Strait, which is now increasingly vulnerable. If security conditions force shipping to reroute via the Cape of Good Hope, delivery times could increase by up to two weeks, sharply raising costs for Indian exporters,” added Ajay Srivastava of GTRI, a trade research body.