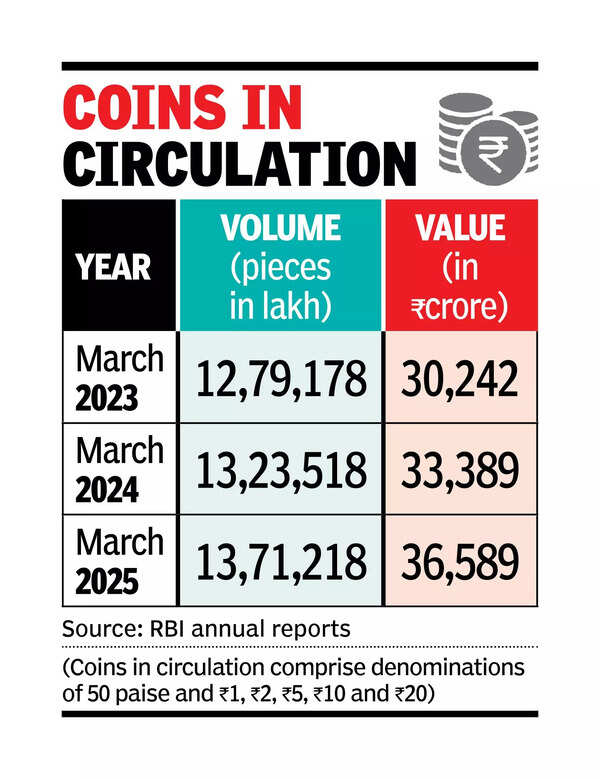

CHENNAI: Coins are going for a toss, literally. Thanks to a substantial jump in UPI transactions, the value and volume of coins in circulation is witnessing a dip YoY.An analysis by TOI based on data in RBI’s annual reports over the past one decade reveals that the volume of coins in circulation increased by just 3.6% in 2024-25 over 2023-24 when compared with 8.5% growth during 2016-17 (when UPI came into being) vs 2015-16. Its value of increase also reduced by about 5% from 14.7% (2016-17 vs 2015-16) to 9.6% (2024-25 vs 2023-24).The volume of coins in circulation in multiple denominations such as 50 paise, Re 1, Rs 2, Rs 5, Rs 10 and Rs 20 stood at 13.7 lakh pieces valuing Rs 36,589 crore as on March 31, 2025. Coins of Re 1, Rs 2, and Rs 5 together constituted 81.6% of the total volume of coins in circulation, while in value terms, these denominations accounted for 64.2%.

Subsequently, the number of UPI transactions spiralled from 6.4 million with a value of Rs 2,425 crore by the end of March 2017 to a whopping 18.3 billion UPI transactions with a value of Rs 24,77,221 crore in March 2025, the National Payments Corporation of India (NPCI) data states. UPI was launched in April 2016.In contrast, coins in circulation recorded a sustained growth in demand till 2016-17. The total value of coins in circulation increased to 14.7% in 2016-17 against 12.4% during the previous year (2015-16). Its total volume marginally went up to 8.5% in 2016-17 from 8.2% in 2015-16. Its growth was the lowest during the Covid year of 2020-21, wherein the total value increased by 2.1% and volume inched up by hardly 1%. Further, its total volume increased by 2.6% and 3.5% year-on-year in 2022-23 and 2023-24, respectively.Coins remain crucial for low-value transactions especially in rural areas, small retail, and public utilities, where digital adoption is limited. According to analysts, minting of higher-denomination coins such as Rs 10 and Rs 20 has contributed to the rise in value terms, even as the broader economy continues to digitise.Vaibhav Koul, MD – technology and digital, Protiviti Member Firm for India said, UPI transactions have significantly contributed to reducing the demand for tendering change, especially in urban and semi-urban areas.