CHENNAI/MUMBAI: India Cements’ new promoter, UltraTech Cement, will need to sell about 7 per cent of its stake, worth over Rs 667 crore, to meet the minimum public shareholding rules set by the capital market regulator. UltraTech currently owns about 82 per cent of India Cements, and the rules mandate that listed companies must have at least 25 per cent of their shares owned by the public.UltraTech’s stake went over 75 per cent after an open offer that was triggered when its holdings in India Cements crossed a specific threshold. The open offer for an extra 26 per cent stake to India Cements’ public shareholders was oversubscribed, which was rare in such offers.India Cements has until Feb 3, 2026, to ensure enough shares are held by the public. It can do this through a secondary share sale, preferential allotment, rights issue, or bonus issue. If it chooses rights or bonus issues, UltraTech will need to give up its rights to buy those shares. Currently, India Cements shares are trading at Rs 333 each, making the 7 per cent stake worth Rs 667 crore.

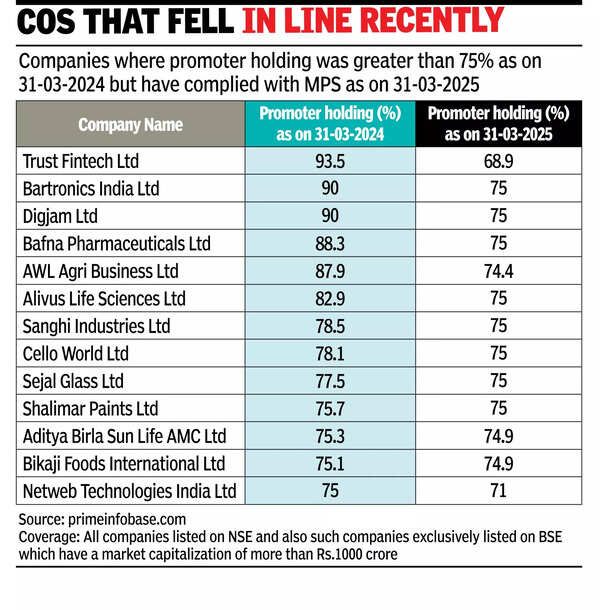

An UltraTech spokesperson said according to Sebi regulations, at least 25 per cent of India Cements’ equity must be held by the public within 12 months after the open offer ends, which was on February 4 of this year. “UltraTech will ensure compliance within the stipulated timeline.”Data from Prime Infobase showed that in FY25, more than a dozen companies saw promoter holdings drop from over 75 per cent to 75 per cent or less. These companies include Sanghi Industries under Adani Group, Aditya Birla Sun Life AMC, Bikaji Foods International, and Cello World. UltraTech, part of the Aditya Birla conglomerate, took control of the loss-making India Cements in the Christmas of 2024. It paid Rs 9,060 crore for the acquisition, which expanded UltraTech’s reach in the growing southern market.During its earnings call in April, UltraTech CFO Atul Daga shared that India Cements reached Ebitda breakeven in the first quarter after its takeover. It also sold over one million metric tons of cement in March, which he called a “second case of sweet success.”Starting in April, with prices rising in the southern market, he believes this will lead to even better results for the company. In FY26, India Cements aims to surpass Rs 500 in Ebitda per metric ton. By FY27, it expects to cross Rs 800, and then hit a four-digit figure.