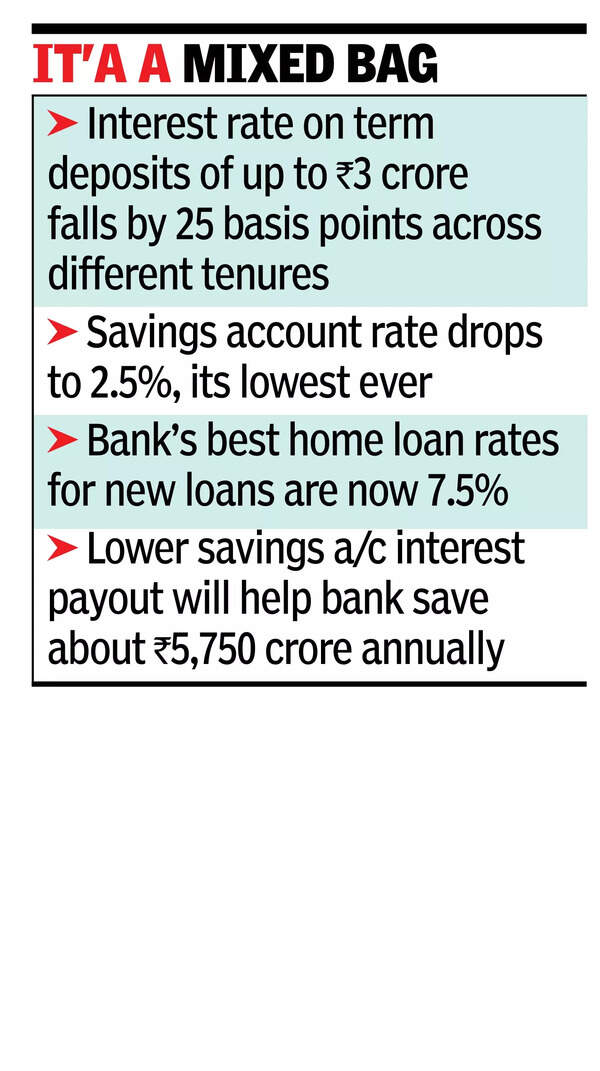

MUMBAI: India’s largest lender, State Bank of India, has cut returns for depositors again. Effective June 15, the bank reduced interest rates on retail term deposits of up to Rs 3 crore by 25 basis points across tenures. Simultaneously, it brought down the savings account rate to 2.5 per cent, its lowest ever. These cuts apply to both new and renewing deposits, reflecting a wider easing in deposit yields after the RBI reduced the repo rate by 50 basis points earlier this month.The rationale behind the uniform cut is protect the bank’s margins. Around 45 per cent of SBI’s Rs 36 lakh crore loan book is linked to the repo rate. These include home loans (Rs 8.3 lakh crore) and auto loans (Rs 1.2 lakh crore). The bank’s best home loan rates for new loans are now 7.5 per cent.

The cut in the benchmark rate is estimated to lower the bank’s annual interest income by about Rs 8,100 crore. Reducing savings deposit rates is the most immediate way for SBI to limit that hit. The cut in savings deposit rates, in particular, provides quicker relief. With Rs 23 lakh crore in such accounts, the lower payout enables the bank to save an estimated Rs 5,750 crore annually.SBI is not alone. HDFC Bank recently trimmed its savings account rate on high-value deposits to a flat 2.75 per cent across balances and lowered fixed deposit rates by up to 25 basis points. ICICI Bank, Canara Bank, and YES Bank have also cut fixed deposit rates. These moves aim to protect net interest margins at a time when credit growth is moderating. For depositors, it marks yet another reduction in already low returns.The deregulation of savings rates had raised hopes of more competition among banks, but the trend has gone the other way. SBI’s savings rate, which was 4 per cent in the early 2000s, slipped to 3.5 per cent by 2003, fell further over the next decade, and hit 2.7 per cent by 2020.