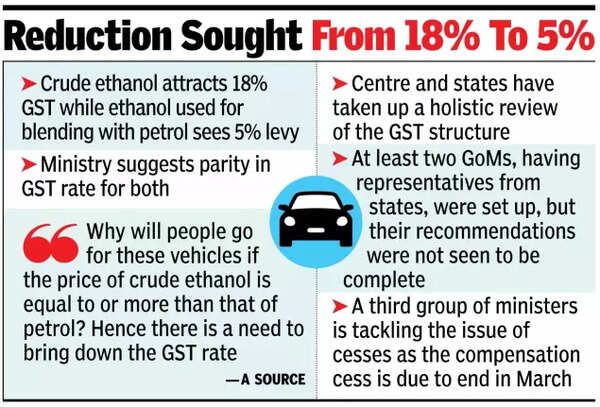

NEW DELHI: At a time when the Centre and states are discussing the rationalisation of the GST structure, road transport minister Nitin Gadkari sought a reduction in the levy on crude ethanol from 18% to 5% to encourage the manufacturing and sale of flex-fuel vehicles.At present, GST on ethanol used for blending with petrol under the Ethanol Blended Petrol (EBP) Programme is 5%. Sources said Gadkari suggested parity in the GST rate for both crude ethanol and the green fuel used for blending in petrol. Currently, around 400 fuel pumps sell 100% ethanol, but demand remains muted.

“Why will people go for these vehicles if the price of crude ethanol is equal to or more than that of petrol? Hence there is a need to bring down the GST rate,” a source said.The suggestion for lower taxes comes at a time when the Centre has taken up a holistic review of the GST structure, instead of limiting it to a select set of goods and services such as life and health insurance. Finance Minister Nirmala Sitharaman and a team of officials at the Centre are looking at the issue in detail before they present the proposals and seek to evolve a consensus.At least two groups of ministers comprising representatives from the states were set up, but the suggestions made by them were not seen to be complete. A third group of ministers is tackling the issues of cesses as the compensation cess is due to end in March.While there is reluctance from state finance ministers to tinker with the four slabs of 5%, 12%, 18%, and 28%, there is growing demand from industry that rationalisation is the need of the hour given that there are several items on which classification concerns have emerged since the regime kicked in eight years ago.Besides, the structure is such that almost two-thirds of the collections come from the 18% slab, although a majority of the items are in the 5% bracket, which yields very little revenue. In the past, there have been discussions around merging the 12% and 18% slabs and putting items in these two brackets at 15-16%. While it will result in some revenue loss, there could also be a political challenge given that items in the 12% bracket will see a higher levy.