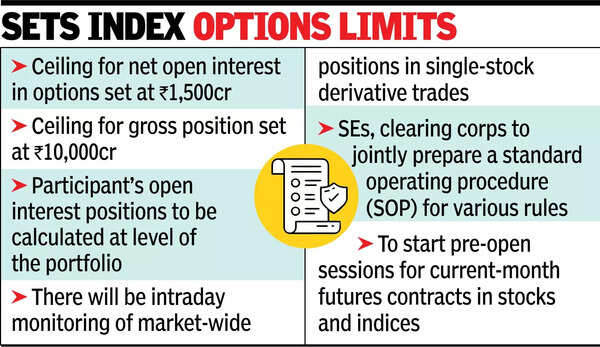

MUMBAI: Markets regulator Sebi on Thursday issued a host of new rules, including setting a limit on the value of open positions in index options, which could strengthen risk monitoring measures and, in turn, make derivatives trading safer. The rules, to be rolled out between July 1 and Dec 6 this year, will link total positions in the derivatives market to the cash market, Sebi said.It also set net open interest positions on options contracts at Rs 1,500 crore and gross positions at Rs 10,000 crore. In addition, it stated that the open interest positions of derivatives market participants will be calculated at the portfolio level. The new rules will also bring in intra-day monitoring of market-wide positions on single stock derivatives.The new rules will lead to better monitoring and disclosure of risks in the F&O segment, reduce instances of spurious F&O ban periods in single-stock contracts, and provide better oversight over the possibility of concentration or manipulation risk in index options, Sebi said in a 21-page release. Sebi also noted that the derivatives market enables efficient price discovery, improves market liquidity, and permits investors to manage risk.

As part of the new rules, bourses will monitor market-wide position limit (MWPL) utilisation at a minimum of four random time intervals during the trading day, Sebi said in the circular. The regulator also stated that in case of any breach of open interest, participants will be given a chance to correct the breach. The exchanges, on their part, could also start levying additional surveillance margins, monitor entity-level concentration, and implement additional surveillance checks. Additionally, the exchanges should report instances of significant utilisation of MWPL or breach of MWPL to the regulator in their fortnightly surveillance meetings.Sebi also mentioned that instances of passive breaches of rules shall not be considered a violation. Sebi further stated that derivatives contracts on non-benchmark indices could be introduced, but such indices should have a minimum of 14 constituents, with the weight of the top constituent not exceeding 20% and the combined weight of the top three constituents not exceeding 45%. It said the constituents’ weights must follow a descending order.