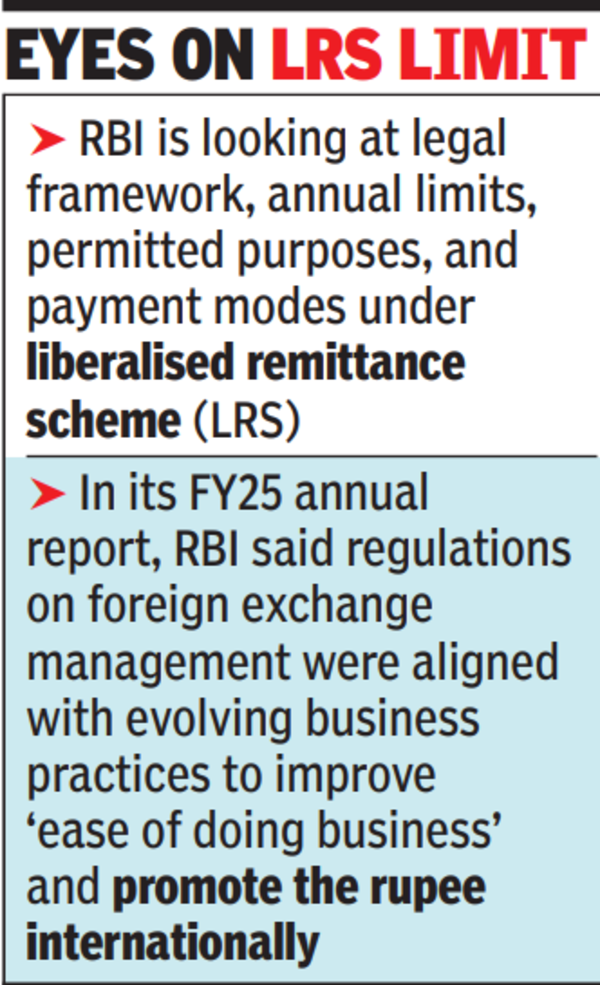

MUMBAI: RBI is reviewing its ‘liberalised remittance scheme’, which saw outflows of around $30 billion in FY25, as it looks to rationalise the facility and promote the rupee as an international currency.RBI is carrying out a comprehensive review of the legal framework, annual limits, permitted purposes, and payment modes under the scheme. A revised framework and amendments to foreign exchange rules and regulations are currently underway.

Similar reviews are ongoing for the money transfer service and rupee drawing arrangement schemes, with the aim of expanding permitted transactions and rationalising guidelines. The focus is on shifting to principle-based regulation and reducing compliance burdens. Earlier, RBI had amended the scheme to enable citizens to make foreign currency investments in international finance centres (GIFT City).In its annual report for 2024-25, RBI said regulations on foreign exchange management were aligned with evolving business practices to improve ‘ease of doing business’ and promote the rupee internationally. The annual report also talks about formalising the expected credit loss (ECL) framework for banks and issue guidelines to curb mis-selling of financial products by regulated entities, including third-party offerings. These reforms, highlighted in its annual report, are part of RBI’s broader effort to enhance financial sector resilience amid growing risks from technology, cyber threats, and climate change.RBI’s rupee internatioalisation efforts include reviewing several existing rules related to external commercial borrowings, export of goods and services, the supervisory framework for authorised persons, inward remittances, and cross-border settlements in rupees and other local currencies.