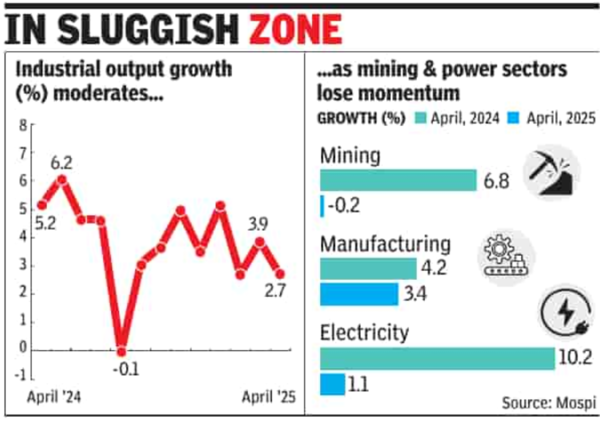

NEW DELHI: The country’s industrial output growth slowed to an 8-month low in April, dragged down by a contraction in mining, sluggish electricity and manufacturing sectors, and a high base effect. Data released by the National Statistics Office (NSO) on Wednesday showed the index of industrial production (IIP) grew by 2.7% in April, lower than the upwardly revised 3.9% in March and below the 5.2% recorded in April last year.The manufacturing sector remained subdued, growing by 3.4% in April, lower than the 4.2% in the same period a year earlier. The mining sector contracted by 0.2% compared with a 6.8% growth in April last year, while the electricity sector rose 1.1% compared with a 10.2% expansion in the same period last year.

“While the IIP growth expectedly eased to 2.7% in April 2025 from the upwardly revised 3.9% in March 2025, the extent of the dip was much lower than expectations, given the slump in the core sector growth, suggesting that the non-core portion of the IIP witnessed relatively healthier growth in the month,” said Aditi Nayar, chief economist at ratings agency ICRA.“The slowdown, albeit mild, was broad-based, driven by a weaker performance across all three production sectors. However, the performance of the use-based sectors was mixed, with three of the six witnessing an improvement, including capital goods, intermediate goods, and consumer non-durables,” said Nayar.The capital goods sector, a key gauge of industrial activity, rose by 20.3% during the month, higher than the 2.8% expansion in April last year, while the consumer durables sector grew by 6.4% in April compared with the 10.5% expansion in April last year. The consumer non-durables sector contracted 1.7% compared with a decline of 2.5% in April last year. The infra and construction goods sector also slowed, rising by 4% in April compared with an 8.5% growth in April last year. “The Centre’s capex contracted by 4% during Jan-Feb FY25 following a pick-up in Q3. Given this weak momentum, the pace of capex revival remains a critical watch going ahead,” said Rajani Sinha, chief economist at ratings agency CareEdge.