CHENNAI: Despite reduction of unsold stock inventory and signs of recovery in the affordable housing segment, it has not enthused developers. Poor conversion rates, spiralling construction costs and unsustainable margins are posing a grave challenge to the affordable housing market.This has resulted in several developers keeping away from launching new projects in the segment. Their reluctance is despite a huge opportunity in this space over the next five years. A report by CII and Knight Frank has projected the cumulative affordable housing demand to reach 31.2 million units with an estimated market size of Rs 67 trillion by 2030.

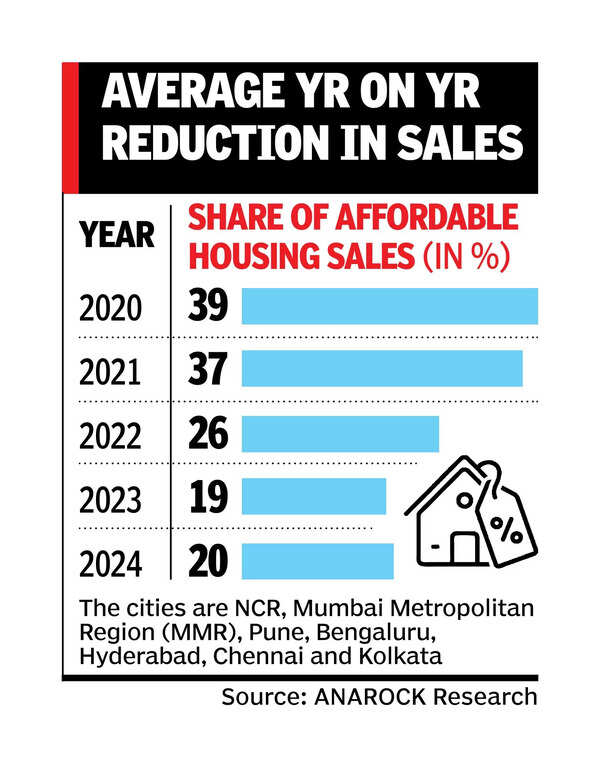

Average year-on-year reduction in sales

Anarock research has found that unsold inventory in the affordable housing segment (It has decreased from 1.4 lakh units in Q1 (Jan-March) CY2024 to a little over 1.1 lakh units during Q1 CY2025. “This trend of declining unsold stock is likely to continue in the upcoming quarters as well,” said Anuj Puri, chairman — Anarock Group. At the same time, the sales share of affordable housing units has plunged to 20% in CY2024 from the figure of 39% four years ago.P Suresh, MD of Chennai-based affordable housing developer Arun Excello said, 90% of developers have shifted out of the affordable housing segment post-Covid in Tamil Nadu. “The pandemic impacted lower salaried employees, who were the core customers of affordable housing. Also, govt’s incentives for affordable housing homebuyers were withdrawn. Subsequently, those buying properties for the purpose of rentals did not pursue their interests,” he said. The company still continues with affordable housing projects around the city. Affordable housing units are those with a carpet area of up to 60 sq m in metropolitan cities and 90 sq m for non-metropolitan cities that are priced less than Rs 45 lakh.