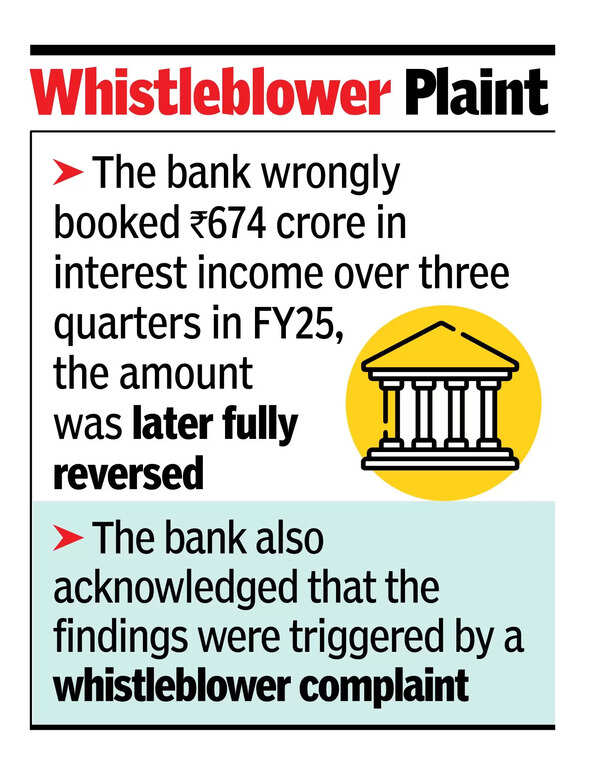

MUMBAI: IndusInd Bank acknowledged further accounting lapses, this time in its microfinance portfolio. The private bank disclosed in a filing to the stock exchanges that it wrongly booked Rs 674 crore in interest income over three quarters in FY25.To offset this, it carried Rs 595 crore in unsubstantiated entries under “other assets.” The bank stated it reversed these amounts in Q4FY25 and has begun internal corrective measures.The disclosure follows an ET report citing a whistleblower complaint and stating that the bank’s internal audit department reopened investigations into past accounting reversals. These included entries under “other assets” and “other liabilities” listed within operating expenses. These developments took place around the time RBI decided to extend CEO Sumant Kathpalia’s term by only a year on March 6. Both Kathpalia and deputy CEO Arun Khurana resigned in the last week of April 2025, taking responsibility for a bigger derivatives accounting lapse that will have a Rs 2,000-crore impact on the bank’s financials.

Whistleblower Plaint

In its letter dated May 15, IndusInd stated the internal audit department submitted its report on May 8. The report found that “a cumulative amount of Rs 674 crore was incorrectly recorded as interest over three quarters of FY24-25,” and confirmed that “this amount was fully reversed as on Jan 10, 2025.” The bank also acknowledged that the findings were triggered by a whistleblower complaint.The ET report noted that the accounting issues were separate from those earlier disclosed. It cited the whistleblower letter sent to both RBI and the bank’s board, which flagged a Rs 600-crore discrepancy in interest income from microfinance and an alleged conflict of interest involving a senior executive.