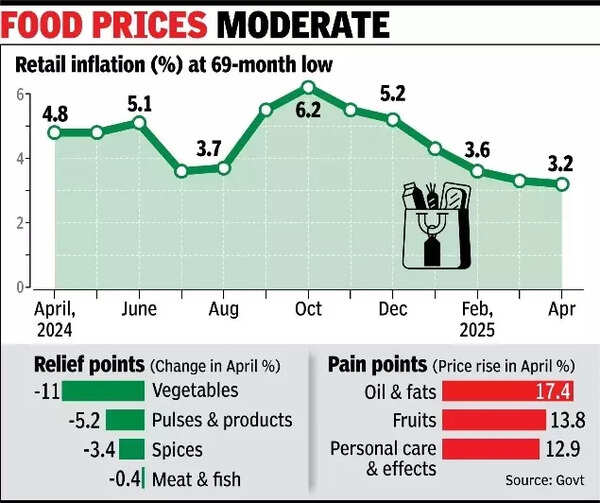

NEW DELHI: Retail inflation eased to a 69-month low in April due to sustained moderation in food prices, triggering hopes that the Reserve Bank of India (RBI) will persist with its interest rate-cutting cycle for now.Data released by the National Statistics Office (NSO) on Tuesday showed retail inflation, as measured by the consumer price index (CPI), slowed to 3.2% in April – lowest since July 2019 – from 3.3% in March. Rural inflation was at 2.9%, while urban inflation was higher at 3.4%. This is the third month in a row that the retail inflation rate has been below the central bank’s target of 4%.

Food inflation was at 1.8% in April, lower than the 2.7% in March. The food inflation in April was the lowest since Oct 2021. The decline in overall inflation and food inflation in April was largely led by a dip in the inflation of vegetables, pulses and products, fruits, meat and fish, and cereals and products. Vegetable inflation contracted nearly 11% in April, while pulses and products were down 5.2%. Two pressure points remained, with fruits and oil & fats inflation rates in double digits during April.Experts expect the RBI to cut rates in June when it meets to review monetary policy, given the headroom provided by the sharp moderation in price pressures. “We anticipate the CPI inflation to average 3.5% in FY26, with the prints for Q2 and Q3 sharply trailing the MPC’s projections for these quarters, allowing for an additional 75 basis points of rate cuts in this calendar year,” said Aditi Nayar, chief economist at ratings agency ICRA.“A 25 basis points (bps) rate cut appears forthcoming in the June 2025 policy, followed by easing of 25 bps each in the Aug and Oct 2025 policy reviews. If GDP growth print for Q4 FY2025 does not report an acceleration from the 6.2% seen for Q3, the MPC may consider front-loading the rate easing, with a 50 bps cut in the upcoming review,” said Nayar.