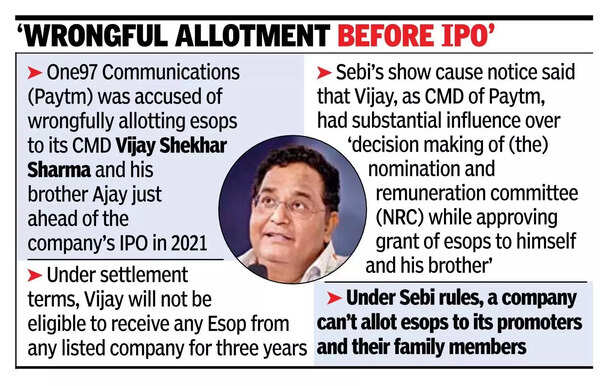

MUMBAI: One97 Communications (Paytm), its chairman & MD Vijay Shekhar Sharma, and his brother Ajay settled a case with markets regulator Sebi for wrongful allotment of esops (employee stock ownership plan) to the brothers just ahead of the company’s IPO in 2021. Under the terms of the settlement, Paytm and Vijay will pay a settlement amount of Rs 1.1 crore each. The company will also cancel 2.1 crore esops that were granted to Vijay and another 2.2 lakh esops to Ajay.Under the settlement terms, Vijay will also not be eligible to receive any esop from any listed company for three years. On his part, Ajay will disgorge Rs 57.1 lakh, the unlawful gain that accrued to him from selling Paytm shares, Sebi papers for settlement of the case showed.

Under Sebi rules, a company cannot allot esops to its promoters and their family members. However, in the case of Paytm, days before the company filed its IPO papers, Vijay derecognised himself as a promoter and was allotted esops. The company also allotted esops to Vijay’s brother, who under the regulator’s rules was categorised under the promoter’s family.Sebi’s show cause notice said that Vijay, as the CMD of Paytm, had substantial influence over “decision making of (the) nomination and remuneration committee while approving grant of esops to himself and his brother”. In addition, there were allegations of non-disclosures by Paytm and Vijay Shekhar Sharma. Sebi’s case was that the Sharma brothers and Paytm violated this esop allotment rule by creating structures just before the company filed its draft offer document in July 2021.After Sebi issued show cause notices to the three entities, there were deliberations between Sebi officials and representatives of the three entities. Finally, the parties entered into a settlement agreement with Sebi “without admitting or denying the findings of fact and conclusions of of law.”