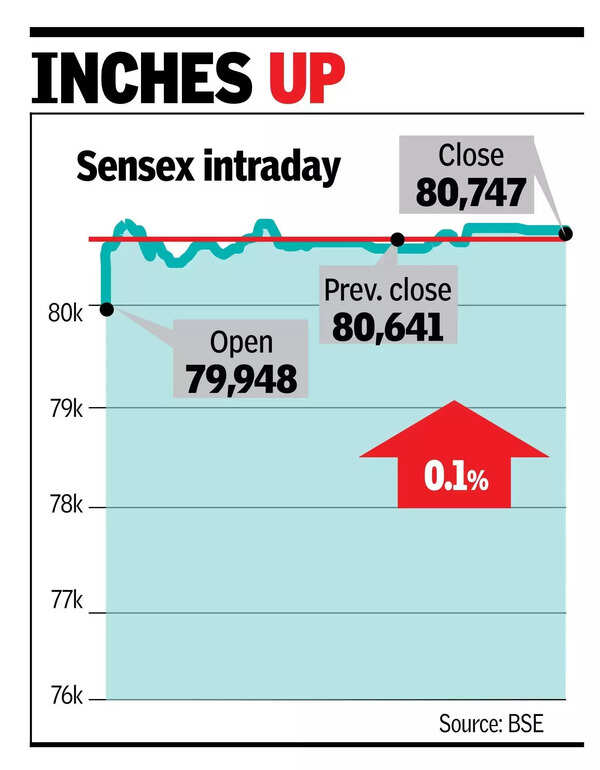

MUMBAI: After a knee-jerk reaction to India’s Operation Sindoor on Wednesday, Dalal Street mostly ignored the prospects of a full-scale Indo-Pak armed conflict and closed marginally higher. The sensex opened about 700 points lower, reacting to the overnight news of the special operations by Indian forces, but quickly recouped the losses and closed 106 points higher at 80,747 points. On the NSE, the Nifty also followed a similar path and closed 35 points up at 24,414 points. The day’s gains came on the back of institutional buying. While foreign funds recorded a net inflow of Rs 2,586 crore in stocks alone, domestic funds net bought stocks worth Rs 2,378 crore, BSE data showed.

According to Prashanth Tapse, senior VP (Research), Mehta Equities, even as the country was in the middle of a military action against terrorist networks across the border, markets witnessed gyration during intra-day trades but eventually managed to shrug off the uncertainty to end slightly higher. While investors are expected to remain cautious due to the ongoing Indo-Pak geopolitical tensions, markets could witness choppy sessions with stock-specific activity over the next few days, Tapse said.Among the 30 sensex constituents, there were 16 gainers and 14 losers. Of the gainers, HDFC Bank and Tata Motors contributed to the index’s gains the most, while selling in Reliance Industries and ITC shaved off part of the gains. The day’s gains added about Rs 2.2 lakh crore to investors’ wealth, with BSE’s market capitalisation now at Rs 423.5 lakh crore.