Mumbai: Indians are pledging more gold than ever. Outstanding bank loans against the precious metal more than doubled in the year to March 2025, rising 103% from just over Rs 1 lakh crore to nearly Rs 2.1 lakh crore, RBI data showed.The surge madegold loans the fastest-growing segment, even as overall bank credit growth slowed to 11% in FY25 from 20% in the previous year.

Several forces drove this boom. In 2023, RBI directed banks to reclassify many agricultural loans as loans against gold jewellery, inflating the numbers. Typically, banks benefit by categorising rural gold-backed loans as agricultural credit as farm loans carry lower interest rates and relatively lenient repayment terms.

Further impetus came after RBI restricted gold lending by a few large non-bank finance companies, pushing more borrowers towards traditional banks. A steep rise in gold prices also enhanced borrowing capacity, as lenders offer funds against the value of jewellery pledged.

Despite the spike in gold loans, overall credit expansion lost steam. Outstanding bank credit stood at Rs 182 trillion at the end of March 2025. While the merger of HDFC with HDFC Bank distorted the base, even adjusted growth slowed to 12% from 16.3% in the previous year. Large industry remained a drag, with credit growth to the sector dipping slightly to 6.2% from 6.4% in FY24.

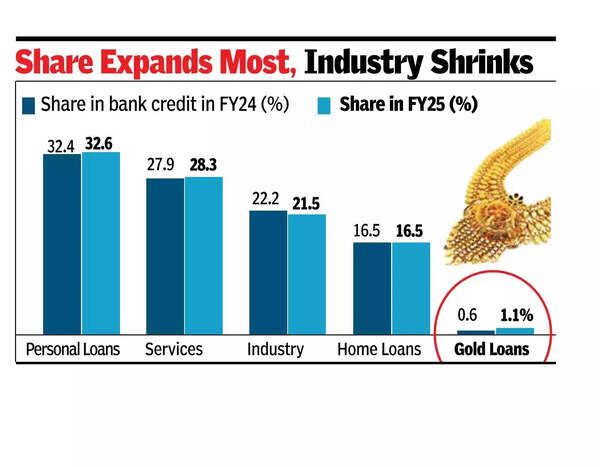

The composition of bank lending continued to shift. Industry’s share fell further to 21.5%, while services rose to 28.3%. Personal loans accounted for 32.6% of all credit, up marginally from 32.4%, helped by the jump in gold loans. The share of housing loans remained steady at 16.5%. Loans against gold jewellery now make up 1.1% of total bank credit, nearly doubling their share from 0.6% a year ago.

Besides gold loans, the second fastest-growing segment was loans against securities, which grew 18.7% to Rs 10,080 crore. Consumer durables were the only category in the retail segment to see a dip, shrinking 1.3% to Rs 23,402 crore. This drop was largely because many lenders reviewed their exposure to unsecured personal loans. Housing loans accounted for 16.5% of personal loans with a portfolio of Rs 30.1 lakh crore.‘Other personal loans’, which largely reflect unsecured loans, grew by 7.9%.