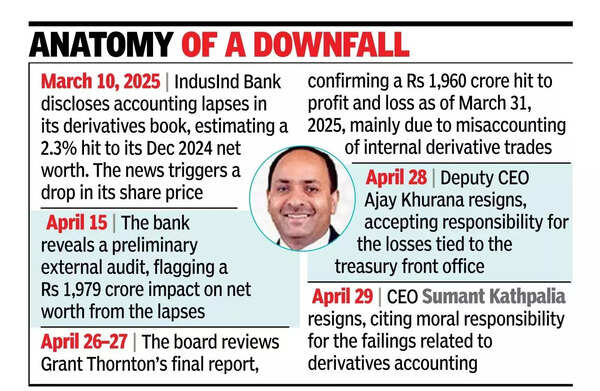

MUMBAI: The managing director and chief executive of IndusInd Bank, Sumant Kathpalia, resigned with immediate effect, assuming what he called “moral responsibility” after derivative losses were recently brought to light.

His departure followed that of the deputy chief executive, Ajay Khurana, who quit a day earlier, citing responsibility for lapses in the accounting of derivatives trades. In Jan, the bank’s CFO Gobind Jain had resigned, which is also being linked to the irregularities.

Sources said that with the board promising to hold employees accountable, more heads could roll.

The resignations came in the wake of a forensic review, believed to have been carried out by Grant Thornton, which pegged the bank’s losses at nearly Rs 2,000 crore. The impact of these hits could significantly impact IndusInd’s fourth-quarter results, compounding existing pressure from its microfinance portfolio. The bank has sought approval from RBI to establish a temporary committee of executives to steer operations while it searches for a new MD & CEO.

Kathpalia, who took the helm in 2020, was instrumental in building the bank’s consumer business after he joined the private lender alongside his predecessor, Romesh Sobti, in 2008. A veteran of multinational banks including Citibank, Bank of America, and ABN Amro, his tenure at IndusInd ended under a cloud.

The accounting discrepancies stemmed from internal derivative trades between the bank’s asset-liability management (ALM) desk and its treasury unit. In IndusInd Bank’s case, external trades were marked to market, meaning any gains or losses were recorded immediately based on prevailing market prices.

However, in the case of internal trades-between the ALM desk and the treasury-they were accounted for on an accrual basis. Losses could be deferred and spread over time, while gains could be recognised earlier than warranted. This mismatch allowed the bank to understate losses while bringing forward notional gains, inflating its earnings.

The bank began engaging in such trades in 2017-18, largely to hedge foreign currency liabilities in yen and dollars. Despite the turmoil, shares of the bank rose nearly 1% on Tuesday.