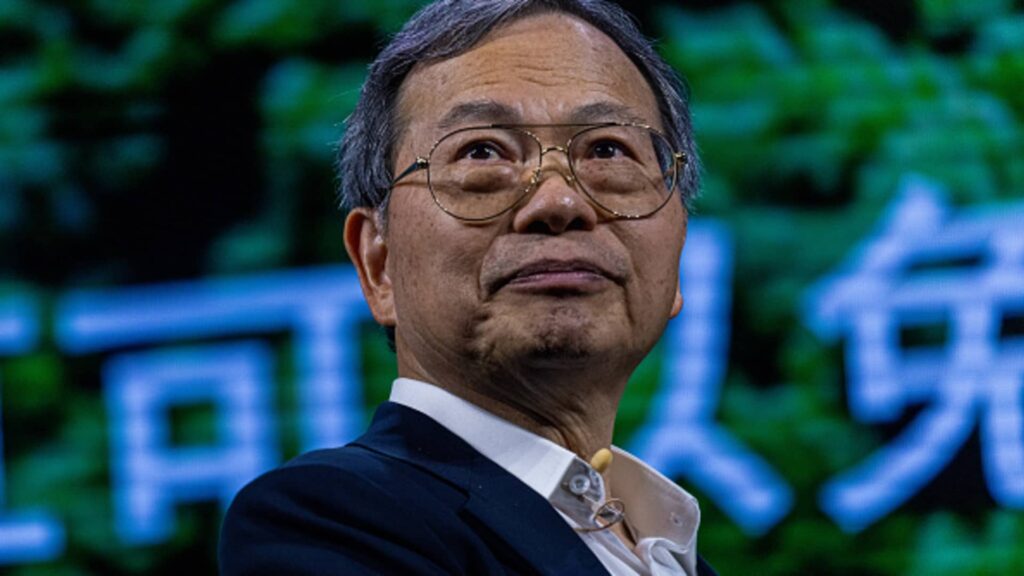

Super Micro Computer CEO Charles Liang at the Computex conference in Taipei, Taiwan, on June 5, 2024.

Annabelle Chih | Bloomberg | Getty Images

Super Micro shares fell as much as 19% on Tuesday after the server maker announced preliminary results for the fiscal third quarter that were lower than analysts had projected.

Here’s how the company’s preliminary numbers compare with the LSEG consensus:

- Earnings per share: 29 to 31 cents per share adjusted vs. 54 cents expected

- Revenue: $4.5 billion to $4.6 billion vs. $5.50 billion expected

Super Micro lowered the ranges from earlier guidance for the quarter, which ended on March 31, according to a statement.

“During Q3 some delayed customer platform decisions moved sales into Q4,” the company said in the statement.

The pre-announcement is the latest blow for Super Micro, which has been mired in controversy for the past year due to delayed financial filings and troubling reports from short sellers. In February, the company filed its financials for its fiscal 2024 year and the first two quarters of fiscal 2025 just in time to meet Nasdaq’s deadline to stay listed. Last year, after Super Micro delayed its annual report, it lost its auditor, Ernst & Young, citing governance issues.

Super Micro will go over the results with analysts on a conference call at 5 p.m. ET on Tuesday, May 6.

— CNBC’s Ari Levy contributed to this report.

This is breaking news. Please refresh for updates.