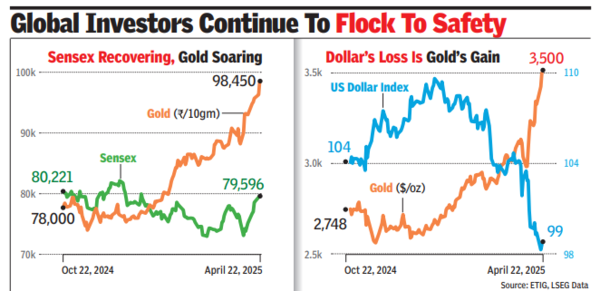

The upsurge in the yellow metal’s rate came after its price in international markets crossed the psychologically important $3,500/ounce mark early in the day.

The rally was fuelled by a combination of factors, including growing fears about a showdown between US President Donald Trump and US Federal Reserve chairman Jerome Powell, global trade uncertainties, a weakening dollar, and central banks’ purchase of gold.

“The rally in gold prices continues to be fuelled by the US Federal Reserve’s reluctance to cut interest rates immediately, despite growing pressure from Trump, who has been vocal about rate cuts,” said Jateen Trivedi of LKP Securities.

“This divergence has further enhanced gold’s appeal as a safe haven, pushing prices to fresh lifetime highs in both Comex and MCX.” However, with prices at record levels, intraday volatility is likely to persist, Trivedi cautioned.

According to Satish Dondapati of Kotak Mahindra MF, another reason for the recent rise in gold prices is the weakening US dollar and escalating global trade concerns.

Since globally gold is priced in dollars, a weak greenback means investors in other major currencies could buy the yellow metal cheaper.

Given gold’s haven character, global uncertainties-economic and geopolitical-help prices move north.

So far in 2025, the price of the yellow metal in the international market is up nearly 32%, while in the Indian market, the rise has been slightly lower, at 30%.

This is because of the appreciation of the rupee against the dollar this year.