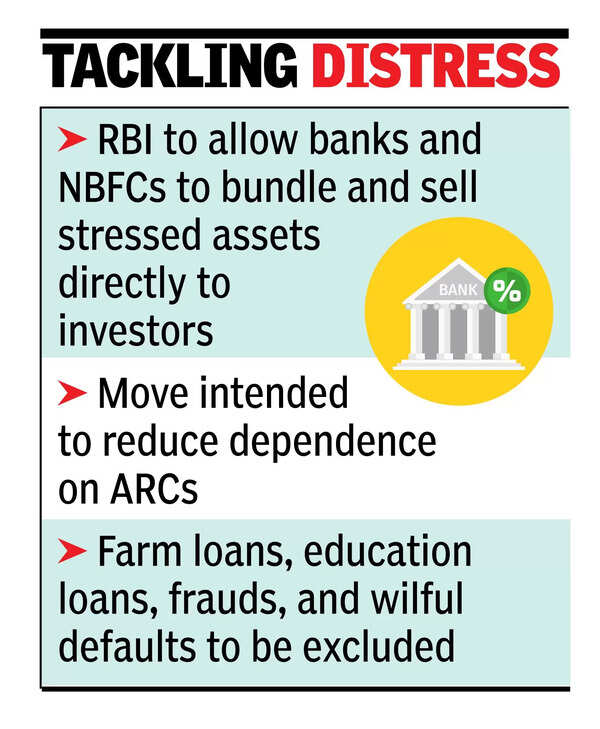

MUMBAI: RBI has proposed a new route for banks and NBFCs to offload bad loans, allowing them to bundle and sell stressed assets directly to investors through special purpose entities set up by regulated financial firms. Until now, only asset reconstruction companies handled such assets. The move, announced with the April monetary policy, is intended to broaden the market for distressed debt and reduce dependence on ARCs.

A key feature is the appointment of resolution managers, tasked with recovering value from the underlying assets. These must be independent of the originating lender. For such loans, RBI-regulated entities can act as resolution managers. For others, insolvency professionals and regulated institutions may qualify. Lenders must gradually provision for the securitised notes over five years. Capital requirements vary with recovery ratings, favoring senior tranches. Any exposure left after five years is to be marked down to Re 1.

With the new dispensation, ARCs may lose some of their market. Larger cases are presently going to the NARCL, and the new framework will now allow lenders to bypass ARCs for mid-sized and retail loans. RBI has also mandated that ARCs must raise their net owned fund to Rs 300 crore by FY26, a threshold many have yet to meet. The new framework retains a key principle of RBI’s regulations on bad loans that are aimed at preventing defaulters getting control of their assets through the back door.