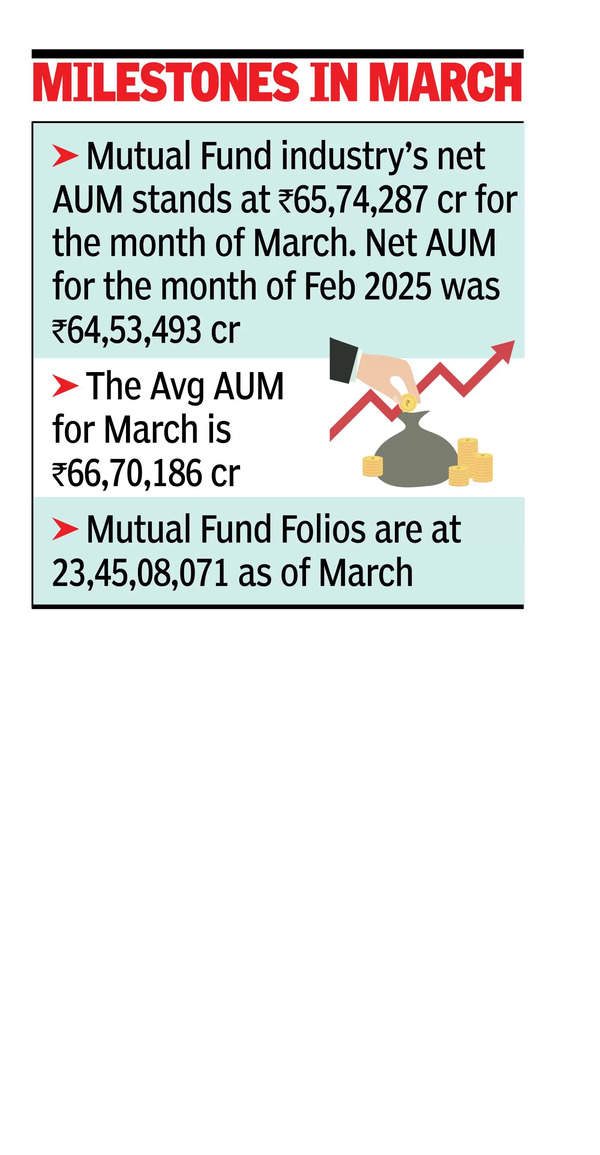

MUMBAI: Total assets managed by the mutual fund (MF) industry jumped 23% or Rs 12.3 lakh crore in fiscal 2025 to settle at Rs 65.7 lakh crore. Of this, about Rs 8 lakh crore came though fresh inflows, while the balance was due to mark-to-market gains, data released by industry trade body AMFI showed.

At close of FY25, total number of folios had jumped to nearly 23.5 crore, an all-time peak. Of these 16.4 crore were in equity funds and 1.6 crore in hybrid funds, AMFI data showed.

During last fiscal, average monthly systematic investment plan (SIP) contribution jumped 45% to Rs 24,113 crore, from Rs 16,602 crore in FY24. “The steady increase in SIP flows is a testament to the growing maturity of retail investors in understanding the importance of systematic and disciplined investing and trust of investors in mutual funds as a core part of their financial planning,” said Venkat Chalasani, Chief Executive, AMFI.

In March, monthly gross inflows through the SIP route, however, showed a marginal dip, at Rs 25,926 crore compared to Rs 25,999 crore in Feb. The dip in flows in March came despite some SIP flows from Feb had spilled over to this month since Feb was a shorter month with some monthly mandates of 30th and 31st being shifted to March.

During the month, debt funds showed a net outflow of Rs 2.02 lakh crore, of which Rs 1.33 lakh crore was from liquid funds and another Rs 30,015 crore from overnight funds.