MUMBAI: Investors on Dalal Street largely discounted the US’s new tariff plans on Thursday with the sensex, after opening about 800 points lower, closed 322 points or 0.4% down. On the NSE, Nifty too took a similar trajectory and closed 82 points or 0.4% lower at 23,250 points. The day’s selling was led by foreign funds who recorded a net selling figure of Rs 2,806 crore, BSE data showed.

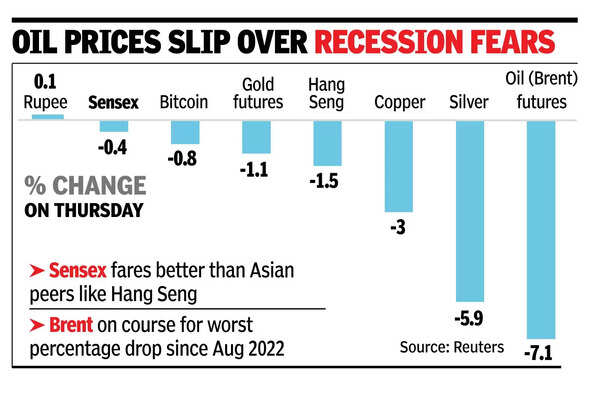

In comparison, the Nikkei in Japan closed 2.8% lower while Hang Seng in Hong Kong lost 1.5% and FTSE in the UK, that closed a few hours after the Indian market, was down 1.6%. In early trades in the US, stocks were deep in the red with Dow Jones down 3.3%, Nasdaq Composite 5.1% and S& 4%.

On Dalal Street, although the two leading indices showed a negative close, midcap and smallcap stocks saw buying interest. As a result, BSE’s midcap index closed 0.3% higher while the smallcap index was up 0.8%. The buying, mainly in midcap and smallcap stocks, made investors richer by Rs 35,000 crore with BSE’s market capitalisation now at Rs 413.3 lakh crore.

Among the sectoral indices, the IT index corrected sharply to close over 4% down while the pharma index rallied to close 1.8% higher.

According to Sundar Kewat of Ashika Institutional Equity, Indian markets opened with a gap down but managed a recovery to close near the day’s high. “The primary catalyst for today’s decline was the deteriorating global sentiment, exacerbated by the US’s President Donald Trump’s announcement of a 26% reciprocal tariff on Indian imports. Additionally, a 25% tariff on auto component imports further dampened market sentiment, prompting a cautious stance among investors,” Kewat said.

Although the domestic markets closed marginally lower on Thursday, as the US markets were sliding in mid-session, market players expect some hard times for Dalal Street investors on Friday.

In the commodity market globally, prices of gold and silver both were deep in the red. On NYMEX, gold futures were down over 1% at $3,135/ounce while silver was down 7.4% at $32.1/ounce. In the domestic market too, prices of gold and silver had softened during the day. In Mumbai, gold closed at Rs 89,600/10 grams, down from Rs 90,500 on Wednesday while silver was at Rs 95,700/kg, down from Rs 99,500 the previous day.