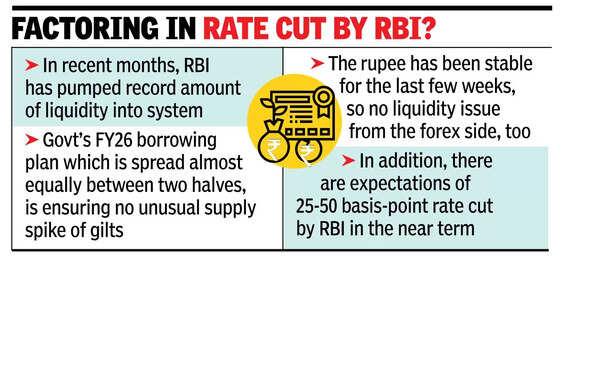

MUMBAI: The benchmark 10-year bond yield on Wednesday fell below the 6.5% mark for the first time in more than three years on easing liquidity, govt’s decision to almost equally spread its borrowings for the fiscal and the stability of rupee in recent weeks. In addition, there are heightened expectations that the RBI will cut interest rates in its meeting next week.

In Wednesday’s market govt bonds maturing in Oct 2034, opened at a yield of 6.55% compared to Tuesday’s close at 6.58%, and rallied through the session to close at 6.48%. For bonds, prices and yields move in opposite directions.

The 10 basis points (100 basis points = 1 percentage point) movement in the benchmark yield was the biggest drop in more than two years. The day’s closing was at the lowest level for the yield since Jan 2022, official data showed.

Bond dealers and economists said that since Jan this year, the RBI has pumped in more than Rs 5.5 lakh crore into the system to ease the liquidity situation that prevailed in Dec 2024. In addition, on Tuesday, the RBI had announced a surprise open market operation to buy bonds worth up to Rs 20,000 crore on Thursday.

While RBI continued with its liquidity-infusion measures, govt of India last Thursday said it would borrow 54% of its planned borrowing for FY26 during the first half, which was lower than what it borrowed during the corresponding period of FY25. This also limited the expected supply of gilts till Sept this year and supported bond prices, bond dealers said.

Along with a stable rupee, the expectations of a 25 basis points rate cut on Apr 9, led to a rally in gilt prices on Wednesday, a bond fund manager said. “Yields are expected to soften further in the absence of liquidity leakage and substantial investor confidence in the market,” added the fund manager. “The expected inflation trajectory, which shows a steady print, is also supporting this bond rally.”