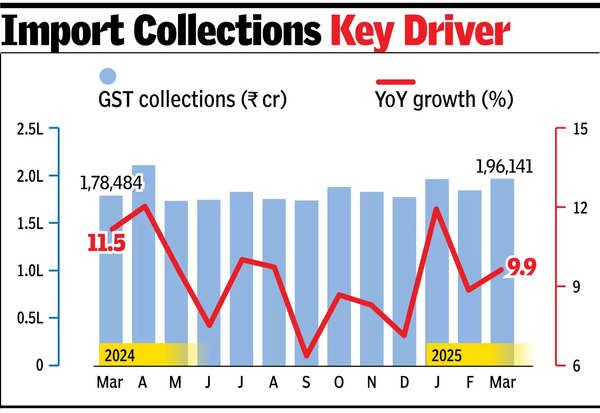

NEW DELHI: GST collections went up 9.9% to Rs 1,96,141 crore in March, second highest monthly collection ever, with the mop-up from imports rising at a much rapid pace. In March, based on transactions in Feb, collections from domestic transactions rose 8.8% to a little under Rs 1.5 lakh, while those from imports shot up over 13% to nearly Rs 47,000 crore.

Average monthly collections were estimated at Rs 1,84,087 crore during the last financial year, compared with Rs 168,187 crore during 2023-24. For the full year, govt estimated an increase of 9.5% to over Rs 22 lakh crore, which marked the slowest pace of expansion since 2020-21, the year that saw massive disruption due to Covid-19 pandemic.

There was also a 41% jump in refunds, pegged at Rs 19,615 crore in March, again driven by a 202% jump in import-related refunds.

“India’s sustained growth in GST collections suggests a resilient domestic economy, seemingly insulated from global economic challenges, driven by strong consumer spending. However, a 13.5% increase in import GST compared to March 2024 highlights a significant rise in imports compared to the same period last year. Further, it’s noteworthy that there has been a 25.7% surge in export refunds year-on-year, which indicates that govt’s manufacturing initiatives are showing positive results,” said Saurabh Agarwal, tax partner at EY India.

The slower growth in collections may increase govt monitoring, tax experts said. “One can expect more rigour in GST audits and scrutiny to plug the leakages. The slowdown in consumption is an area, which also needs to be addressed,” said Pratik Jain, partner at PwC.

During the last financial year, Haryana (16% rise), Delhi (15.9%), Maharashtra (12.4%) and Bihar (12.1%) were the top performers. Arunachal and Nagaland saw collections decline by 8% and 4%, respectively.