During March, FPIs sold ₹6,027.8 crore ($637.3 million) in secondary market equities whilst investing ₹2,055.2 crore ($236.1 million) in the primary market. (AI image)

Foreign portfolio investors demonstrated a mixed investment pattern in March, marking their third straight month as net sellers of Indian equities. However, the outflow significantly decreased due to robust purchasing activities in the month’s latter half.

They invested a net sum of ₹26,042 crore ($3,037 million) in the second half of March, contrasting with the ₹30,015 crore ($3,438 million) outflow during the first fortnight, according to an ET report. The overall monthly net outflow decreased to ₹3,973 crore ($401.2 million).

It’s important to note that the future foreign investment levels will be influenced by various factors, including America’s trade policies under US President Donald Trump’s administration, the comparative appeal of the Indian economy versus the recession-threatened US market, and the value proposition of domestic equities.

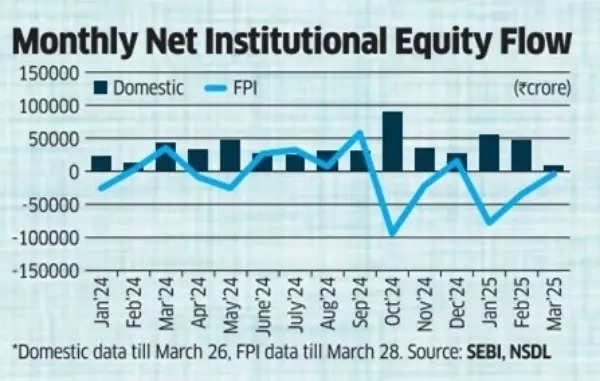

Net Monthly FPI Flow in Equities

- During March, FPIs sold ₹6,027.8 crore ($637.3 million) in secondary market equities whilst investing ₹2,055.2 crore ($236.1 million) in the primary market.

- Throughout FY25 (April-March), they remained net sellers, offloading equities worth ₹1,27,041 crore ($14,626 million) across both markets.

- This represents the second-highest outflow, following FY22’s divestment of ₹1,40,010 crore ($18,468 million).

Monthly Net Institutional Equity Flows

Domestic funds exhibited an opposite trend to FPIs. Their net equity investment in March totalled ₹9,147.6 crore, lower than the ₹13,516.6 crore invested until March 7.

This indicates that local funds reduced their equity positions during the month’s latter period, whilst foreign investors increased their purchases.