NEW DELHI/ MUMBAI: In a fresh lifeline to Vodafone Idea, govt has decided to convert Rs 36,950 crore of spectrum dues into equity, making it the largest shareholder in the telecom company with a holding of almost 49%.

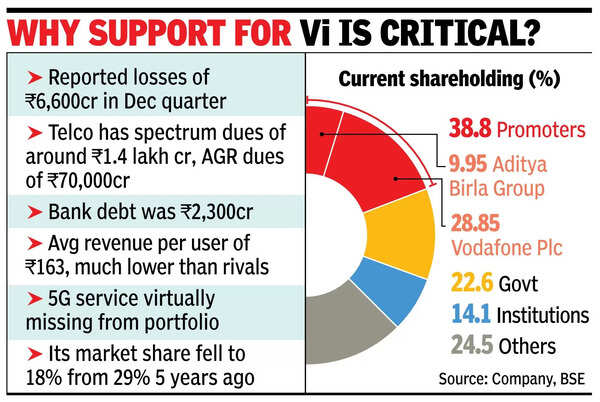

Following the fresh issue of shares to the Centre, promoters’ holding will fall from 39% to 26%. Specifically, Vodafone Group Plc‘s stake in the Indian unit will fall to 16% from 29%, limiting its ability to veto special resolutions. Aditya Birla Group chairman Kumar Mangalam Birla and his affiliated entities’ ownership will decrease to 9.4% from 10%.

Despite these changes, in line with the earlier govt decision, the promoters will maintain operational control of the country’s third largest mobile service provider, a source told TOI.

The latest bailout is seen to be crucial for the company as it will free cash flow, which would have gone towards payment of govt dues, and enable it to invest in capex, especially the rollout of 5G services, where it is absent, barring in Mumbai. Better services would, in turn, help improve the billing per customer. Not only has the company seen its average revenue per user hover at around Rs 160 a month – two-thirds the level of rival Bharti Airtel (Rs 245) and 25% lower than Reliance Jio (Rs 203) – but it has also lost premium customers.

At the end of Dec, Trai data pegged Vodafone Idea’s market share at 18%, compared with Reliance Jio’s 40% and 33.5% for Airtel.

Govt’s move will also reduce the cash outgo as interest is calculated on the outstanding, further pushing up the liability. During a presentation to analysts, the company management had estimated govt dues at around Rs 2.1 lakh crore. In the next fiscal year, it was required to pay close to Rs 30,000 crore to govt towards spectrum and AGR dues, with the amount projected to rise further in 2026-27. These liabilities are, however, expected to come down now.

The latest conversion is also expected to provide comfort to banks, which may offer fresh debt, especially after the recent fund raising by Vodafone Idea.

Govt has been supporting Vodafone Idea as well as BSNL as it is keen to ensure that there are at least three private players and a strong state-run entity to ensure that consumers have enough choice and competition remains healthy amid fears that the sector was turning into a duopoly with Reliance Jio and Bharti Airtel calling the shots.

Although govt will become the largest shareholder, it would still be classified as a public shareholder. In 2022, when the Centre had initially acquired a 33% stake by converting outstanding interest dues to equity, it was exempted from making an open offer to Vodafone Idea shareholders.