Kotak said top banks are raising one-year wholesale deposits at around 8%, which translates to a marginal deposit cost of over 9% after factoring in CRR, SLR, deposit insurance, and priority sector lending requirements – excluding operating expenses.

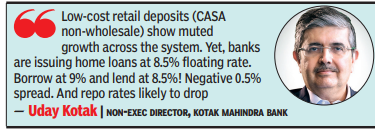

“Low-cost retail deposits (CASA non-wholesale) show muted growth across the system. Yet, banks are issuing home loans at 8.5% floating rate. Borrow at 9% and lend at 8.5%! Negative 0.5% spread. And repo rates likely to drop,” he said in a post on X.

Congratulations!

You have successfully cast your vote

Kotak questioned how banks would manage operational and credit costs if the tight deposit situation persists, warning that it could pose a challenge to their business model. Most banks have their retail floating rate loans linked to the repo rate and have to mandatorily pass on any rate cut by the RBI.

The comments come as bond markets saw a steep fall in yields, anticipating a further liquidity infusion by RBI ahead of its monetary policy committee decision in early April. The yield on the 10-year bond ended at 6.58% on Friday, down from 6.6% on Thursday.

Between Dec and March, RBI infused around Rs 6.2 lakh crore of durable liquidity into the banking system via a CRR cut, forex swaps, and open market bond purchases. The liquidity shortfall, as reflected by bank borrowings, has shrunk to around Rs 20,000 crore. A persistent shortfall prevents interest rate transmission to other banks.

Most economists say proper rate cut transmission requires RBI to maintain liquidity in surplus by at least 0.5% to 1.5% of total bank deposits. Many banks have called for a more predictable framework, with some bond dealers expecting RBI to move toward a daily repo.