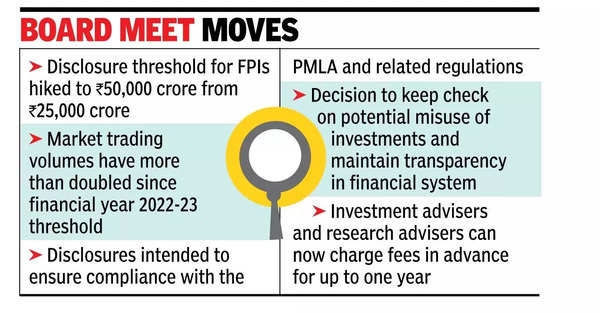

MUMBAI: Markets regulator Sebi on Monday doubled the asset threshold to Rs 50,000 crore for foreign portfolio investors that are required to make additional disclosures about persons holding units of their funds. The reason: The market size has increased. Sebi, in a release after its board meeting on Monday, said this was done after it was seen that trading volumes in the cash market had more than doubled between FY23 and FY25.

“FPIs holding more than Rs 50,000 crore of equity AUM in the Indian markets will now be required to make additional disclosures,” of “details of all entities (up to the level of natural person) holding any ownership, economic interest, or control, on a full look through basis, without any thresholds,” the release said. This specific requirement was put in place so that a “large-sized FPI with the potential to disrupt the orderly functioning of markets by their actions”, is prevented from doing the same.

In addition, all FPIs have to meet the KYC, Prevention of Money Laundering Act and Prevention of Money Laundering (Maintenance of Records) Rules.

Sebi on Monday also made some changes relating to public interest directors and key managerial personnel of market infrastructure institutions, including doing away with the Sebi-imposed cooling off period for such officials moving to a competing entity.

The Sebi board also gave its nod to the proposal that if the governing board of an market infrastructure institution decides not to re-appoint an existing public interest director after his/her first term, it must record the rationale for this decision and communicate it to the regulator.

The board also gave its nod to the proposal that investment advisers and research advisers can now charge fees in advance for up to one year, up from two quarters and one quarter, respectively. However, the same has to be agreed between the client and the investment adviser or research adviser.

Speaking to the media after the board meeting, Sebi chief Tuhin Kanta Pandey, said that the regulator will continue to impress upon govt to get PSUs to meet the minimum public shareholding norms. Often, it’s found that PSUs do not meet the MPS norms, like promoters’ shareholding remaining above the 75% threshold limit. Sebi officials, however, agreed that it may not always be possible to pressurise some PSUs to cut govt (promoter’s) stake quickly to meet MPS norms.