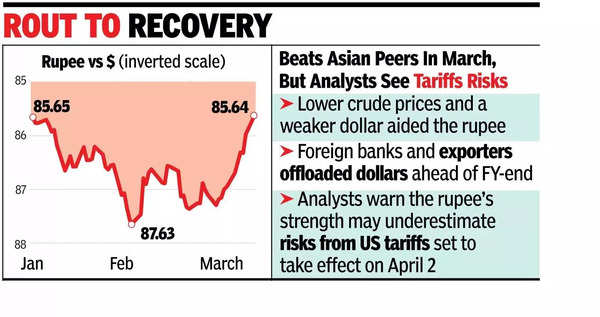

MUMBAI: The rupee’s rally on Monday saw the domestic currency erase its 2025 losses as corporates repatriated dollars and foreign inflows returned to bonds and equities. The rupee touched 85.5 against the dollar intraday, its highest level since late 2024, before settling at 85.64, up 33 paise from Friday.

The rupee extended its winning streak to nine sessions, buoyed by dollar inflows from inter-company borrowings and corporate profit repatriation resulting in the currency being the best performer in Asia in March. Seasonal factors and $3 billion in bond inflows added momentum, while foreign equity purchases further lifted the currency.

Foreign banks sold dollars, pushing the rupee higher, while exporters sought to capitalise earlier gains. The currency rose 2.1% in March, outpacing regional peers.

“Rupee traded positive, driven by strong FII buying over the last few days, which has reversed the fund flow impact on the rupee. Additionally, expectations of Russia-Ukraine truce talks have kept market liquidity active, further supporting the rupee’s momentum,” said Jateen Trivedi of LKP Securities.

He added that if the dollar index remains below 104 and FII inflows continue, the rupee could inch towards the 85/$ zone this week.

Despite the rally, resistance is expected as importers step in. Analysts warn that the rupee’s strength may underestimate risks from US tariffs set to take effect on April 2.

Lower crude prices and a weaker dollar supported the rupee. Foreign banks and exporters offloaded dollars ahead of the financial year-end, while RBI stayed largely on the sidelines.