MUMBAI: L&T plans to raise Rs 12,000 crore through debt instruments for its financial requirements while announcing organisational modifications at the $27-billion company. It will explore non-convertible debentures, external commercial borrowings, and term loans, with detailed terms to be disclosed upon finalisation.

On Friday, Subramanian Sarma, who currently leads the energy unit, was promoted to the position of deputy MD of the company. He will officially assume his new role on April 2. Sarma, 67, joined L&T’s board directly in 2015, coinciding with S N Subrahmanyan’s appointment as deputy MD. Subrahmanyan, 65, who is often referred to as SNS, currently serves as the chairman and MD of L&T.

The company traditionally opts for debt-based fundraising, utilising the amount to refinance matured debt and meet capital expenditure needs. During fiscal 2024, the company issued non-convertible debentures worth Rs 7,000 crore and commercial papers totalling Rs 46,975 crore.

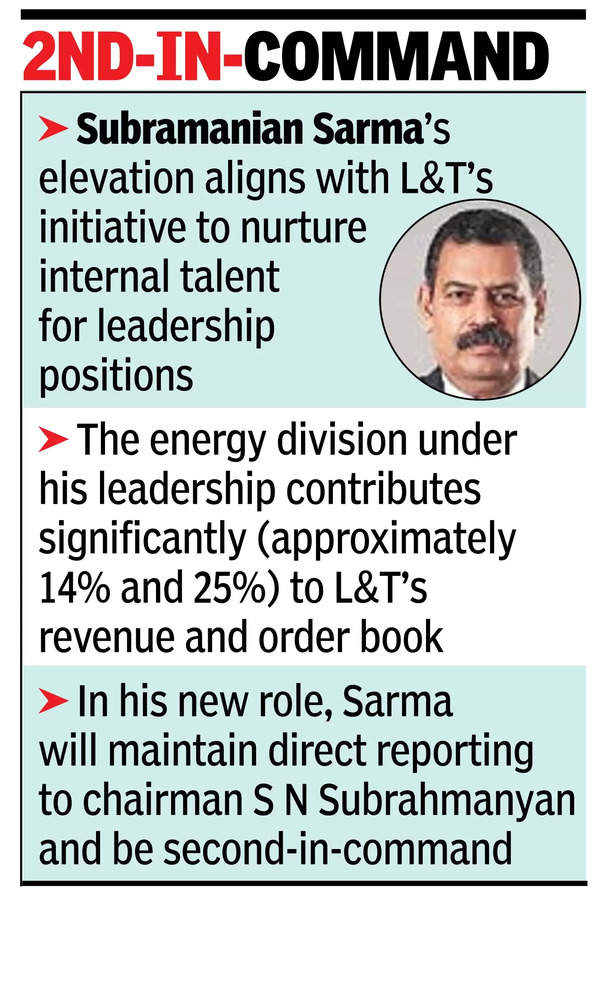

Sarma’s elevation aligns with L&T’s initiative to nurture internal talent for leadership positions. The energy division under his leadership contributes significantly (approximately 14% and 25%) to L&T’s revenue and order book. In his new role, Sarma will maintain direct reporting to SNS and be second-in-command.

L&T said Sarma’s deputy MD appointment will be for three years, valid until Feb 3, 2028, by which time he will turn 70. The company’s HR policy stipulates retirement at 70 for executive directors.

L&T has six of its executives on the board. Besides SNS and Sarma, there is R Shankar Raman (handles finance), S V Desai (oversees civil infrastructure), T Madhava Das (utilities) and Anil Parab (heavy engineering).

The company said it has reappointed Desai and Das for five additional years from July 11. It further said it will allot 17,150 equity shares to “those grantees who had exercised their options under the company’s employee stock option schemes”. L&T operates without an identifiable promoter, with its employees through a trust owning 14% of the company, which is often referred to as a proxy for the investment cycle in the country.