MUMBAI: India’s economy continues to display remarkable resilience amid global uncertainty, with growth underpinned by strong agricultural output and recovering consumption, the Reserve Bank of India (RBI) noted in its State of the Economy report.

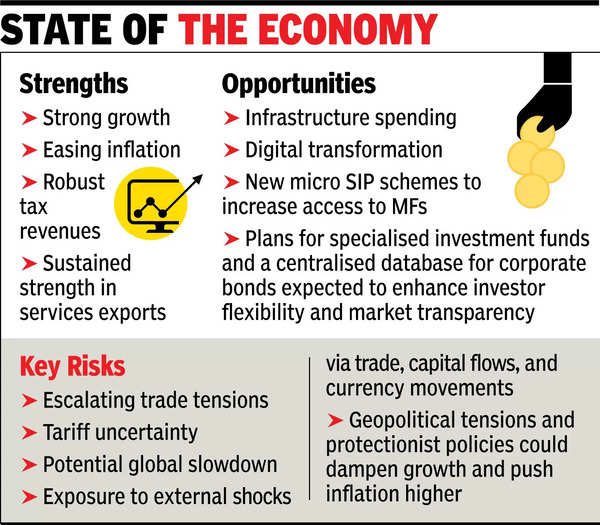

Key sectors – including agriculture, construction, financial services, and trade – remain buoyant. The country is benefitting from easing inflation, robust tax revenues, and sustained strength in services exports.

Meanwhile, the central bank has responded nimbly to liquidity shortages. According to the report, RBI has pumped in over Rs 5.3 lakh crore of durable liquidity through bond repurchases, forex swaps and long-term repos.

“The first revised estimates (FRE) of GDP for FY24 placed the real GDP growth at 9.2% – the highest in over a decade if we exclude the post-Covid rebound – demonstrating that in an uncertain world, India’s growth story remains a beacon of stability and progress,” the report observed.

Inflation has moderated, with headline CPI falling to a seven-month low of 3.6% in Feb. “The decline in overall inflation is expected to further support recovery in consumption and bolster macroeconomic strength, which would act as a bulwark to ward off the myriad of external challenges,” the report added.

Leading indicators suggest that demand remains robust in the final quarter of FY25. “Activity indicators such as e-way bills and toll collections recorded double-digit (y-o-y) growth in Feb 2025,” the report noted.

Yet risks abound. The report flags escalating trade tensions, tariff uncertainty, and a potential global slowdown as key threats. India remains exposed to external shocks via trade, capital flows, and currency movements. Geopolitical tensions and protectionist policies could dampen growth and push inflation higher. “The reverberations of a tumultuous external environment, however, are being reflected in sustained foreign portfolio outflows,” the report cautioned.