Microsoft Corp, the biggest backer of Sam Altman’s OpenAI, and BlackRock Inc, which has an executive on the artificial intelligence startup’s board, are joining forces with one of his chief rivals.

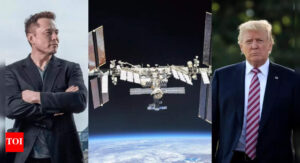

Microsoft and BlackRock said on Wednesday that Elon Musk’s xAI is joining their effort to build $30 billion worth of data centers and other artificial intelligence infrastructure. The AI chipmaker Nvidia Corp, which was already named as a technical adviser to the group when it was announced last year, is also formally joining, according to a statement that didn’t detail member commitments.

Microsoft, which has invested about $13 billion in OpenAI, has increasingly been developing AI outside of that partnership. The software giant has created in-house AI models that it believes can compete with OpenAI, Bloomberg reported this month. Musk, also a co-founder of OpenAI, has meanwhile publicly feuded with Altman over the company’s efforts to shift to a for-profit structure.

The capital demands and enthusiasm for AI have prompted a range of companies and investors to forge alliances to build some of the biggest data centre campuses in the world. US President Donald Trump has touted hundreds of billions of dollars worth of commitments from firms including Softbank Group and OpenAI, which are behind a $100 billion AI investment plan dubbed Stargate.

The Microsoft-backed group will be renamed the AI Infrastructure Partnership, or AIP, and focus on infrastructure investments – including energy projects – mostly in the US, with a portion of the funds to be deployed in partner countries, according to the companies. The plan foresees bringing on additional investors. Clients, including pensions and insurers, are eager for such long-term infrastructure projects, BlackRock chief executive officer Larry Fink said in the statement.

BlackRock and Microsoft last year unveiled the coalition in partnership with MGX, a UAE investment vehicle that is also involved in Stargate, and Bayo Ogunlesi’s Global Infrastructure Partners. The companies said at the time they would seek $30 billion of private equity capital over an unspecified time frame and eventually leverage as much as $100 billion in potential investments.