MUMBAI: RBI has pumped in over Rs 5 lakh crore into the banking system since mid-Jan through bond purchases, forex swaps and early-April maturity repos. To ensure that liquidity remains surplus so that its rate cut can be transmitted to borrowers, the central bank plans to inject another Rs 50,000 crore through bond repurchases on Tuesday.

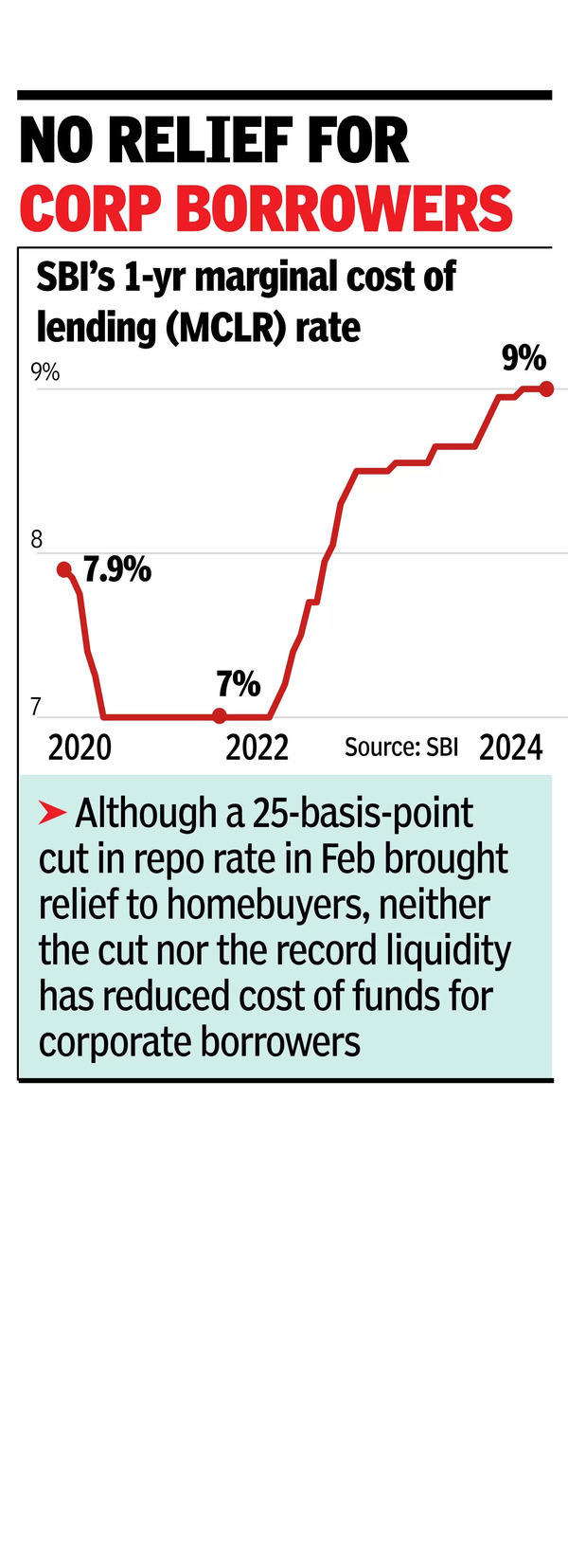

Although a 25-basis-point cut in repo rate in February brought relief to homebuyers, neither the cut nor the record liquidity has reduced cost of funds for corporate borrowers. This is because the interest rate for corporates depends on the one-year marginal cost of lending rates, which reflects that cost at which banks raise funds. The one-year MCLR for the country’s top lender State Bank of India has been rock steady at 9% – the highest level since RBI started raising rates.

While the central bank has undertaken record liquidity infusion, the reaction of money markets has been muted largely because of year-end demand for funds and the rise in yields globally. Banks are reluctant to reduce interest rates on term deposits because credit growth (9.5% until end-Feb) continues to outstrip deposit growth (8.8%).

Since RBI reduce the repo rate no major bank has brought down its deposit rate. The lowering of FD rates has been done largely by some small finance banks who have been reassessing their growth targets given the stress in the sector. Currently there are seven small finance banks and four private banks offering over 8% rates on the fixed deposits.

Second, even as RBI infuses record liquidity, it continues to drain rupees out of the banking system by selling dollars from its forex reserves. This sale of dollars has helped stabilise the system and the liquidity measures have helped address immediate shortages, but they have not yet fully succeeded in reducing short-term interest rates due to ongoing liquidity deficits and economic uncertainties.

With the year-end pressure to lend, bankers say that cost of funds will decline in the first quarter of FY26.