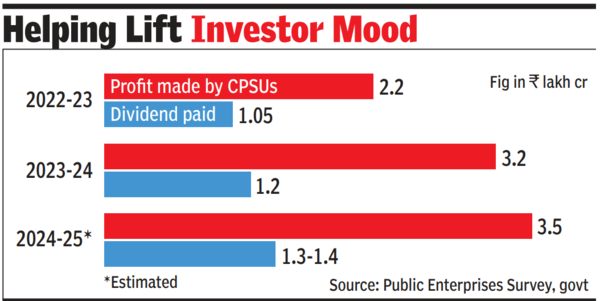

NEW DELHI: Central public sector undertakings (PSUs) are on course to pay record dividends of Rs 1.3-1.4 lakh crore during the current financial year, which will not just help govt end the fiscal with a better than budgeted mop-up but will come as a boon for lakhs of retail investors in these stocks.

Dividends will come on the back of profits of these companies projected to top the Rs 3.5 lakh crore mark for the first time, according to official estimates, which will be at least 10% higher than last year’s level.

The department for investment and public asset management (DIPAM) and the department of public enterprises (DPE) have decided to enforce govt guidelines, which mandate that at least 30% of the profits or 4% of the net worth should be shared in the form of dividends, leaving enough money for the PSUs to invest in capex, which is another focus area for the Centre.

“We want public enterprises to act as a role model in the stock market and will urge the private sector to do the same and declare fair dividends so that confidence of common citizens and ordinary investors can be restored in the stock market,” said Arunish Chawla, secretary, DIPAM, who is also in-charge of DPE. Of the 266 PSUs, 66 are currently listed on stock exchanges.

A higher dividend payout will also help the Centre earn around Rs 10,000 crore more than the revised estimate for the current financial year and can help improve the overall fiscal deficit, which is pegged at 4.8% of GDP.

In the budget, govt has budgeted for dividend receipts of a little under Rs 2.9 lakh crore, which includes those from the Reserve Bank of India and public sector banks and insurance companies.

Govt estimates suggest that capex by central PSUs could be of the order of Rs 3.6 lakh crore in the current fiscal year, compared with Rs 3.5 lakh crore last year. It is projected to grow almost 20% to Rs 4.3 lakh crore in 2025-26, augmenting the Centre’s efforts to invest more in asset creation and generate demand for inputs such as steel and cement, while also creating jobs.