NEW DELHI: The oil ministry has slapped a demand for $2.8 billion on Mukesh Ambani-led Reliance Industries and its partner BP operating the KG-D6 block off the Andhra coast, even as the consortium prepares to challenge a Delhi high court order upholding the government’s claim in a decade-old battle that has come to be known as the ‘gas siphon case’.

The ministry sent the notice on Monday, days after a division bench of the high court last month quashed an earlier single-judge order that had upheld an international arbitration award in RIL-BP’s favour and rejected the govt’s claim.

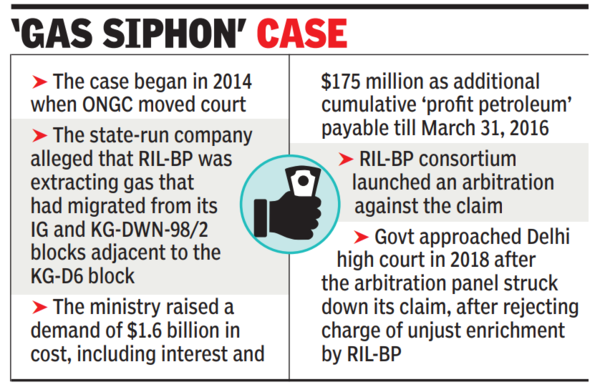

The case began in 2014 when state-run ONGC moved court, alleging RIL-BP was extracting gas that had migrated from its IG and KG-DWN-98/2 blocks adjacent to the KG-D6 block.

Soon thereafter, the ministry raised a demand of $1.6 billion in cost, including interest, and $175 million as additional cumulative ‘profit petroleum’ payable till March 31, 2016, for what an independent committee under retired Delhi HC chief justice A P Shah described as RIL-BP’s “unjust enrichment” by producing the migrated gas.

The consortium launched an arbitration against the claim. The govt in 2018 approached the Delhi High Court after the arbitration panel rejected the charge of unjust enrichment by RIL-BP and struck down its claim.

A single-judge bench of justice Anup Jairam Bhambani on May 9, 2023 upheld the arbitration award and rejected govt’s claim.

Last month, the division bench of justices Rekha Palli and Saurabh Banerjee quashed that order and rejected the international arbitration tribunal’s ruling in favour of RIL-BP.

The consortium, however, does not see any immediate liability arising from the ministry’s demand note since it is challenging the latest Delhi High Court order in the Supreme Court, the company said in a stock exchange filing on Tuesday.

Originally, Reliance held 60% interest in Krishna Godavari basin deep-sea block KG-DWN-98/3 or KG-D6, while BP had 30% and Canadian firm Niko held the remaining 10%. Subsequently, Reliance and BP took over Niko’s interest in the production sharing contract (PSC) and now hold 67% and 33%, respectively.