NEW DELHI: Women seeking credit grew three times between 2019 and 2024, reflecting increased demand among female borrowers, while about 60% of women borrowers availing credit were from semi-urban or rural areas, a report showed on Monday.

Since 2019, women’s share in business loan origination has increased by 14% and their share in gold loans has grown by 6%, with women accounting for 35% of business borrowers by Dec last year, according to the report prepared by govt think tank Niti Aayog, Transunion Cibil and MicroSave Consulting.

The report examines the evolving role of women in the country’s economic growth, focusing on their untapped potential and the systemic barriers they face. Women constitute nearly half of country’s population but contribute only 18% to the GDP.

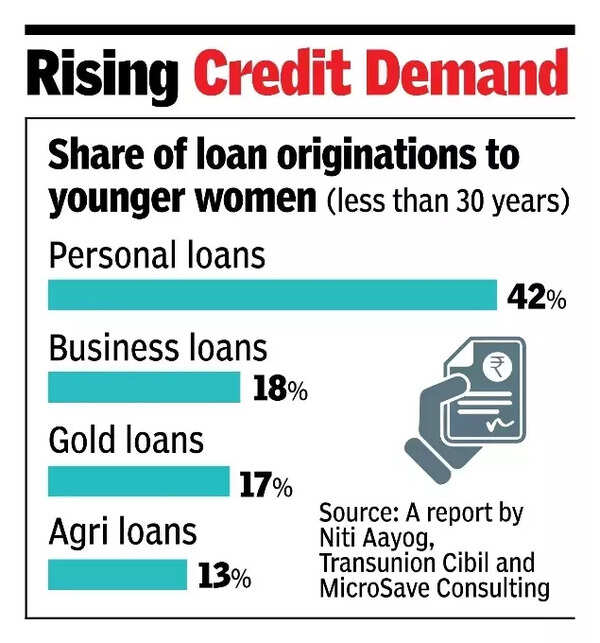

The report showed that women under 30 years of age account for only 27% of retail credit, compared to 40% for men.

By 2024, 42% of loans availed by women were for personal finance, a marginal increase from 39% in 2019. While the credit supply to women in business sectors has improved, the majority of loans availed by women continue to be against gold – 36% of all loans availed by women in 2024 were gold loans compared to 19% of loans availed in 2019, according to the report.

“The findings are encouraging. A 42% year-on-year increase in women actively monitoring their credit health demonstrates a significant step towards financial awareness and responsible credit management,” said B V R Subrahmanyam, CEO of Niti Aayog.