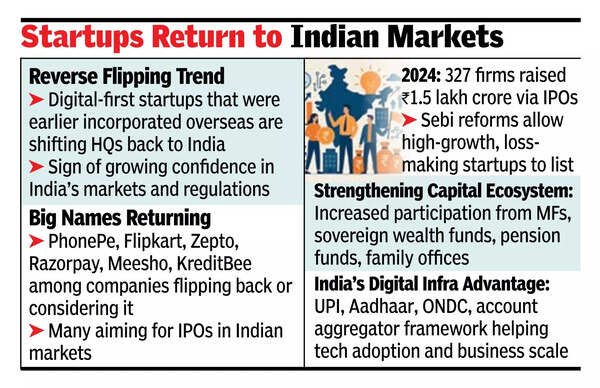

BENGALURU: India’s maturing capital markets are prompting digital-first companies to shift their headquarters back to the country. A white paper from Bay Capital Investment Advisors highlights this “reverse flipping” phenomenon, where startups previously registered in countries like the US, Singapore, or the Netherlands are returning to India, showcasing increased faith in domestic markets, regulatory improvements, and a broader investor base.Approximately 40 Indian consumer internet and technology firms have domestic listings, with their collective market value reaching $90 billion. Several prominent firms including PhonePe, Groww, Zepto, Flipkart, Razorpay, Pine Labs, Udaan, Meesho, KreditBee, and InMobi have flipped or considered a return, with plans to list on Indian exchanges.Several elements contribute to this transformation. Indian investors have developed expertise in assessing digital enterprises using metrics such as customer acquisition cost (CAC), lifetime value (LTV), and user retention. Market regulator Sebi’s reforms have enabled high-growth companies, despite losses, to access public markets. Enhanced participation from mutual funds, pension funds, sovereign wealth funds, and family offices has strengthened the investment landscape.

Public listings have increased significantly. During 2024, 327 firms raised Rs 1.5 lakh crore through public offerings, compared to Rs 20,628 crore in 2020. Notable digital enterprises, including Swiggy, FirstCry, Ola Electric, Unicommerce, and TBO Tek, launched their public offerings, demonstrating investor interest in technology-driven growth opportunities.Bay Capital identifies India’s highly sophisticated digital infrastructure-UPI, Aadhaar, ONDC, and Account Aggregator framework as crucial drivers.The trend extends beyond the consumer internet. India’s deep technology sector is expanding, with ventures in AI, quantum computing, space technology, and enterprise software securing substantial funding. Nasscom-Zinnov data indicates deep tech startups secured $1.6 billion across 310 deals in 2024, rising 78% year-on-year, with AI representing nearly half the investment.While Bay Capital maintains optimism about India’s digital and technological future, it advocates careful investment selection. The report emphasises that “robust business models, distinctive competitive advantages, healthy organisational culture, and sustainable profitable growth remain essential when evaluating potential investments” in the country.